chemistry-oge-ege.ru

Market

No Opening Deposit Checking

There is no enrollment necessary and no fee for this service. Not all direct deposits are eligible for TD Early Pay. Eligible direct deposits are limited to. Banking account and one Business Advantage Savings account can be included for no opening deposit by transferring money from your existing account. If you're. Free Checking made for today. No monthly 1 service charge. No minimum balance. Plus, you'll get a debit card that's protected from fraud. Early access to military pay with direct deposit; No monthly service fee; No minimum balance requirement; Free personalized checks. Rates: % APY; Exclusive Visa® offers and perks. Ready to open a no-fee Essential Checking account? Open My Account. Direct Deposit Express. Get paid up to two days early. Chase Secure BankingSM. Chase Debit Card Art. No minimum deposit to get started. Get started. Early direct deposit—with direct deposit, get your money up to two business days early · No Chase fee at non-Chase ATMs · No Chase fees for checks · Earns interest. The Checking account has no monthly cycle service charge and no minimum balance required to open or maintain the account. Compounding and crediting -. Clear Access Banking. Bank account with no overdraft fees. Period. Open with $ How to avoid the $5 monthly service fee · Open now. There is no enrollment necessary and no fee for this service. Not all direct deposits are eligible for TD Early Pay. Eligible direct deposits are limited to. Banking account and one Business Advantage Savings account can be included for no opening deposit by transferring money from your existing account. If you're. Free Checking made for today. No monthly 1 service charge. No minimum balance. Plus, you'll get a debit card that's protected from fraud. Early access to military pay with direct deposit; No monthly service fee; No minimum balance requirement; Free personalized checks. Rates: % APY; Exclusive Visa® offers and perks. Ready to open a no-fee Essential Checking account? Open My Account. Direct Deposit Express. Get paid up to two days early. Chase Secure BankingSM. Chase Debit Card Art. No minimum deposit to get started. Get started. Early direct deposit—with direct deposit, get your money up to two business days early · No Chase fee at non-Chase ATMs · No Chase fees for checks · Earns interest. The Checking account has no monthly cycle service charge and no minimum balance required to open or maintain the account. Compounding and crediting -. Clear Access Banking. Bank account with no overdraft fees. Period. Open with $ How to avoid the $5 monthly service fee · Open now.

No monthly service fee; No opening deposit requirement; No minimum balance requirement. Best For: Anyone who wants a flexible standard account for everyday use. Chase Secure BankingSM. Chase Debit Card Art. No minimum deposit to get started. Get started. There is no charge for your first order of checks and you'll enjoy unlimited check writing. Account details: No minimum deposit to open; No monthly service fee. LifeGreen® Checking. Everyday banking with perks. Monthly fee options: $0 with a monthly direct deposit of at least $ $25 or $0 · Digital banking — no paper check writing · A great start for students and young adults — no monthly fee if under age 25 · Helps prevent overspending —. Enjoy banking made easy with Ally Bank's Spending Account - online checking, spending buckets, and no minimum deposits. Ally Bank, Member FDIC. No monthly service charge for 6 years · Combines checking and savings · Overdraft alerts and protection, including Low Cash Mode® in the PNC Mobile App. Open a One Deposit Checking account from Citizens today. Enjoy no minimum balance or monthly maintenance fee with just one deposit of any amount per. The Truist Simple Business Checking account is straightforward, with no monthly maintenance fee. Perfect if you're just getting started with your business. Use your mobile phone to deposit checks — and save yourself a trip to your local branch. Q: What is the Old National Bank routing number? A: The Old. Open an online checking account from SoFi and see why it was awarded Best Checking Account of No minimums, no account fees, up to 2-day-early. No surprise fees. Pay a $ monthly maintenance fee with no minimum balance penalty. Fee cannot be waived. Banking essentials. Directly deposit paychecks. Checking account with no minimum daily balance required. Debit card IDs required to open. Open an Everyday Checking account. $25 minimum opening deposit. Classic Checking · Standard checks included at no cost · $ minimum balance to open · $6 monthly service charge; waived if you maintain a $ daily balance or a. Everyday Benefits. Ways to avoid Monthly Service Fees with $+ in Enhanced Direct Deposits · Citi Priority. Preferred banking with no Monthly Services Fees. Can I Open A Bank Account With No Deposit · Ally Bank. Ally Bank is a high-interest option with unique online integrations such as mobile check deposits, money. Open an online checking account with cashback debit today. Earn cash back, enjoy no fees, and experience the freedom of a free checking account. Truist One Checking has a $50 minimum opening deposit. Consider a Truist Confidence Account. No overdraft fees; No personal checks; No check cashing fees. With a Fifth Third Momentum® free checking account, we mean no in the best possible way—with no minimum balance requirement, no minimum deposit, and no monthly. Everyday Benefits. Ways to avoid Monthly Service Fees with $+ in Enhanced Direct Deposits · Citi Priority. Preferred banking with no Monthly Services Fees.

Mortgage Rates Bismarck Nd

Today's mortgage rates in North Dakota are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. Mortgage Rates as of Wednesday, September 4, ; Conventional, / , % / 0% ; North Dakota Roots, Rate, Origination Fee - Discount Points. Compare North Dakota mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. eLendingNow was established in Bismarck, North Dakota in with one purpose in mind; helping you find the right mortgage program for you and your situation. Daily Mortgage Rates ; yr fixed, % ; yr fixed FHA, % ; 7-yr ARM, % ; 5-yr ARM, %. Conventional fixed-rate loans in the USA offer stable monthly payments with a constant interest rate over 15, 20, or 30 years. Borrowers typically need a down. Today's mortgage rates in Bismarck, undefined are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Mortgage Rates in Bismarck, ND ; 30 Yr Fixed, , , + The current average year fixed mortgage rate in North Dakota decreased 64 basis points from % to %. North Dakota mortgage rates today are 8 basis. Today's mortgage rates in North Dakota are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. Mortgage Rates as of Wednesday, September 4, ; Conventional, / , % / 0% ; North Dakota Roots, Rate, Origination Fee - Discount Points. Compare North Dakota mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. eLendingNow was established in Bismarck, North Dakota in with one purpose in mind; helping you find the right mortgage program for you and your situation. Daily Mortgage Rates ; yr fixed, % ; yr fixed FHA, % ; 7-yr ARM, % ; 5-yr ARM, %. Conventional fixed-rate loans in the USA offer stable monthly payments with a constant interest rate over 15, 20, or 30 years. Borrowers typically need a down. Today's mortgage rates in Bismarck, undefined are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Mortgage Rates in Bismarck, ND ; 30 Yr Fixed, , , + The current average year fixed mortgage rate in North Dakota decreased 64 basis points from % to %. North Dakota mortgage rates today are 8 basis.

From fixed rate and adjustable rate mortgage loans to Capital Credit Union is a full-service financial institution with locations in Bismarck. Looking for current mortgage rates in Bismarck, ND? Here's how to use our mortgage rate tool to find competitive interest rates. This covers the cities of Bismarck, Grand Forks, and Fargo. Particularly in places where there is a shortage of available homes, rental rates might be. Browse all Rate Branches in Bismarck, ND to get a low cost home purchase, mortgage refinance and fast closings. Get approved online! Mortgage Rates as of Thursday, September 5, ; Conventional, / , % / 0% ; ** FirstHome DCA, Rate, Origination Fee - Discount Points ; Government. Fixed-Rate Mortgages. Choose loans that give you 10, 15, 20, 25 or 30 years to repay; Stable monthly mortgage payments make for easier monthly budgeting. First Community Credit Union Homepage. () Login Home Loans Home Mortgage Loans Learn More Borrower Portal Learn More Home Equity Loans. Fixed Rate Loans ; % to % · % to % · % to % · % to %. North Dakota mortgage rates offer you the very best in affordable financing. The most popular cities in North Dakota are: Fargo, Bismarck, and Grand Forks. Daily Mortgage Rates ; yr fixed, % ; yr fixed, % ; yr fixed FHA, % ; 7-yr ARM, %. The average North Dakota rate for a fixed year mortgage is % (Zillow, Jan. ). North Dakota Jumbo Loan Rates. North Dakota county conforming loan. At present the mortgage rates in North Dakota are % for a 30 year fixed loan, % for a 15 year fixed loan and % for a 5 year ARM. North Dakota. Compare today's mortgage rates for Bismarck, ND. The mortgage rates in North Dakota are % for a year fixed mortgage and % for a year fixed. Metropolitan Areas ; 2, , Bismarck, ,, , ; 3, , Grand Forks, ND-MN Metro Area, ,, 98, Visit Rate at N 5th St. #, Bismarck, ND for assistance with low cost home purchases, mortgage refinance and fast closings. Get approved online! The APR calculation assumes a loan of $10,, a fixed interest rate of % or a variable interest rate of %, a loan fee of % and a year repayment. WalletHub selected 's best mortgage lenders in Bismarck, ND based on user reviews. Compare and find the best mortgage lender of Compare mortgage rates in North Dakota to find the best mortgage rate for your financing needs. Home loan interest rates in North Dakota for new homes. Take advantage of our one-of-a-kind program, featuring no fees and fixed interest rates when you finance your student loan and mortgage with us. Mortgage Loans. We are rebuilding the mortgage process. We are located in Bismarck, ND. Call us today

Buying A Car With Car Allowance

Under most car allowance or reimbursement programs, you don't have control of the vehicles your employees are driving. With a company car program, you can. Yes you'll pay tax & ni on that so you'll have to fund, fuel and maintain the car on the net figure. Bonus and overtime if at all won't take the allowance into. Using a car allowance to purchase a car could mean that you profit from it when it comes to selling it on in the future. Disadvantages of car allowance. Just. Economic Analysis of the Car Allowance Rebate System ("Cash for Clunkers") The Car Allowance Rebate System (CARS) is one of several stimulus programs whose. If you are paid a car allowance as part of your salary and wages, though, you may be able to claim vehicle related deductions. Provided your travel falls under. A car allowance is a cash allowance added to your annual salary for you to arrange a lease or buy a vehicle. You will not have to pay BIK on a car allowance. A car allowance doesn't save you on tax and is treated as taxable income. It doesn't matter how little or how much you use the car for work, all of your. A company car allowance is a cash allowance that is added to your annual salary, which allows you to buy or lease a vehicle yourself. A car allowance is a sum of money that the business adds to the employee's annual salary—allowing them to either buy or lease a vehicle. Under most car allowance or reimbursement programs, you don't have control of the vehicles your employees are driving. With a company car program, you can. Yes you'll pay tax & ni on that so you'll have to fund, fuel and maintain the car on the net figure. Bonus and overtime if at all won't take the allowance into. Using a car allowance to purchase a car could mean that you profit from it when it comes to selling it on in the future. Disadvantages of car allowance. Just. Economic Analysis of the Car Allowance Rebate System ("Cash for Clunkers") The Car Allowance Rebate System (CARS) is one of several stimulus programs whose. If you are paid a car allowance as part of your salary and wages, though, you may be able to claim vehicle related deductions. Provided your travel falls under. A car allowance is a cash allowance added to your annual salary for you to arrange a lease or buy a vehicle. You will not have to pay BIK on a car allowance. A car allowance doesn't save you on tax and is treated as taxable income. It doesn't matter how little or how much you use the car for work, all of your. A company car allowance is a cash allowance that is added to your annual salary, which allows you to buy or lease a vehicle yourself. A car allowance is a sum of money that the business adds to the employee's annual salary—allowing them to either buy or lease a vehicle.

5 benefits of a car allowance · Having the option to buy your own car with the cash sum you receive. · If you already own a car and have no plans to upgrade the. there are benefits to keeping your own car and using your allowance for the running costs and car repayments, or to buying yourself a new car. we'll help. If you qualify, you'll receive a one-time payment of $25, to buy a car, truck, or van. While it may not cover the entire cost of a vehicle, it reduces. Conversely, with a car allowance, workers receive a fixed monetary sum each month. They have the freedom to utilise this amount towards purchasing or leasing. A fair car allowance covers all your costs of vehicle ownership and business travel in that vehicle – assuming you are using a reasonable vehicle for your job. A car allowance is a cash amount paid directly to an employee's salary. An employee can use that money to buy or lease a car directly, instead of using a. With an allowance, employees are free to choose between buying a car, leasing a car or else using the allowance to help fund their current vehicle. In. The Car Allowance Rebate System (CARS), colloquially known as "cash for clunkers", was a $3 billion U.S. federal scrappage program intended to provide. The car allowance could either pay for the purchase or lease price of the vehicle. The one thing common is that there will be a vehicle in either situation. Purchase, maintenance, gas, and garaging of the vehicle are your responsibility. The allowance is to compensate you for the gas and wear and. Car allowances can be great for staff retention and for giving your workforce the cash sum they need to buy a car for work. Whether they have some level of. A car allowance is a fixed amount of money that you give to your team designed to cover the expenses of using their vehicles for work. You can choose whether to lease or buy the car. With the allowance, you could choose to buy a vehicle so that you own it and will therefore keep it, should you. A car allowance is a cash benefit type of scheme that a business can offer to their employees to help with the cost of funding a vehicle they use for business. A company car allowance, also known as 'cash for car', is — put simply — a salary enhancement paid to the employee in lieu of the provision of a company car. The Car Allowance shall be used at Executive's discretion toward the purchase/lease of an electric vehicle of Executive's choice. Executive understands that the. You can claim capital allowances on cars you buy and use in your business. This means you can deduct part of the value from your profits before you pay tax. A car allowance can cover the likes of car finance repayments, car insurance, fuel, repairs, maintenance and registration & CTP cover. You can choose whether to lease or buy the car. With the allowance, you could choose to buy a vehicle so that you own it and will therefore keep it, should you.

Casinos With 10 Minimum Deposit

Check our $10 minimum deposit casinos that fit perfectly to gamblers looking for new gambling sites giving first deposit bonus. Best Online Casinos With No Minimum Deposit: · WildCasino – $20 minimum + $9, Bonus · SuperSlots – $20 minimum + $6, Bonus · MyStake – $ minimum + $/£/€. The best $10 deposit casinos in the US · WOW Vegas · Pulsz · Stake · Gambino Slots · Golden Heart Games. 1. Bet While Bet is renowned for its sportsbook, the online casino is equally deserving of attention. As a $10 minimum deposit casino in the USA, it. Many online casinos allow minimum deposits as low as $5; use our exclusive bonus codes (see below) on top of that for some extra free money to get started. The deposit 10 get bonus slots with an additional free 50 dollars is found at Coral, Cracker Bingo, Redbus, Hippodrome, Paddy Power, Yay Bingo casinos. If you. Enjoy a wide selection of online casino games at Slots Empire Casino ➡️ Up to $ Welcome Package ✓ Safe and Secure Deposit Methods ✓ 24/7 Support. Lowest minimum deposit casinos — Real-money casinos: BetMGM with a $10 deposit, Tropicana with a $5 deposit. The concept of casinos with $10 minimum might not be especially complicated. It's the lowest amount you can put into your betting account – simple as that. Check our $10 minimum deposit casinos that fit perfectly to gamblers looking for new gambling sites giving first deposit bonus. Best Online Casinos With No Minimum Deposit: · WildCasino – $20 minimum + $9, Bonus · SuperSlots – $20 minimum + $6, Bonus · MyStake – $ minimum + $/£/€. The best $10 deposit casinos in the US · WOW Vegas · Pulsz · Stake · Gambino Slots · Golden Heart Games. 1. Bet While Bet is renowned for its sportsbook, the online casino is equally deserving of attention. As a $10 minimum deposit casino in the USA, it. Many online casinos allow minimum deposits as low as $5; use our exclusive bonus codes (see below) on top of that for some extra free money to get started. The deposit 10 get bonus slots with an additional free 50 dollars is found at Coral, Cracker Bingo, Redbus, Hippodrome, Paddy Power, Yay Bingo casinos. If you. Enjoy a wide selection of online casino games at Slots Empire Casino ➡️ Up to $ Welcome Package ✓ Safe and Secure Deposit Methods ✓ 24/7 Support. Lowest minimum deposit casinos — Real-money casinos: BetMGM with a $10 deposit, Tropicana with a $5 deposit. The concept of casinos with $10 minimum might not be especially complicated. It's the lowest amount you can put into your betting account – simple as that.

In this case, the casino should accept deposits as low as $ The most popular casinos for $10 deposits are currently Adrenaline & Slotum. You can always read. The most common limits at low deposit casinos are for example $1, $5 and $ Also we have come across at least a few sites that offer $15 minimum deposits. What's the best minimum deposit casinos in the US? Online casinos with $1 to $10 minimum deposits depending on which casino is right for you! What Is a $10 Minimum Deposit Casino? Casinos that allow players to fund the account with lower amounts of money, including $10 are known as low-deposit casinos. Are you looking for a Bitcoin casino that accepts a low deposit? We have listed and compared the lowest minimum deposit BTC casinos! Top Online Casinos with Min 10 Deposit for ; Casushi 3. Casino Bonus. £ + 50 BONUS SPINS. VISIT CASINO Read Review +More details ; Uptown Pokies 2. Casino. List of the best $10 minimum deposit casino sites · BetMGM – Excellent overall experience with enticing new customer promotion · Unibet – A well-rounded casino. Skrill and Neteller are the most popular e-wallets with US players and online casinos alike. Other options include Paysafecard, PayPal, and Click2Pay. These all. The five best casinos with a deposit of $10 in Canada · Bing Bong Casino · Jackpot Pirates Casino · Bambet Casino · 20Bet Casino · Freshbet Casino. Betway, $10, Claim the welcome bonus of % match with the $10 minimum deposit. Payment options: Mastercard/Visa PayPal PayNearMe. Cash at Cage VIP Preferred. Try slots and table games for as little as $10 thanks to minimum deposit online casinos in Michigan. We break down the best ones here. Below, you will find a list of bonuses at €10 minimum deposit casinos. Check them out and pick one or more you'd like to try today. What is a minimum deposit casino? · Borgata Casino: $5 minimum deposit, $20 no-deposit bonus, % match up to $1,, $10 minimum withdrawal. · DraftKings Casino. The minimum deposit is $10 for Neosurf, $20 for BTC, $20 for ETH, $20 for LTC, $20 for Flexepin, $20 USDT, and $30 for Credit Card. The code is valid 5 times. Imagine, with just a 10 CAD deposit, you're opening doors to the vast world of Canadian online gambling. Play real money games with $10 Minimum Deposit. GET $ BONUS and play + games at Las Atlantis Casino: ⚓ Slots ⚓ Blackjack ⚓ Roulette ⚓ Live. Lowest Minimum Deposit Online Casinos - $1 to $5 Minimum Deposit Casino Sites ; neteller logo. Neteller ; ecopayz logo. EcoPayz ; pay by phone logo. Pay-by-. However, there are those casino sites that accept even lower minimum deposits. Some will accept minimum deposits of €10 but there are also those casinos that go. Check out our best $10 minimum deposit casinos in the US. Read our review to discover the best sites offering 10 dollar deposits and where to play top. For Canadian online casino fans, the chance to collect 55 free spins for a top slot for only a $1 deposit is very attractive. Exclusively for Canadian players.

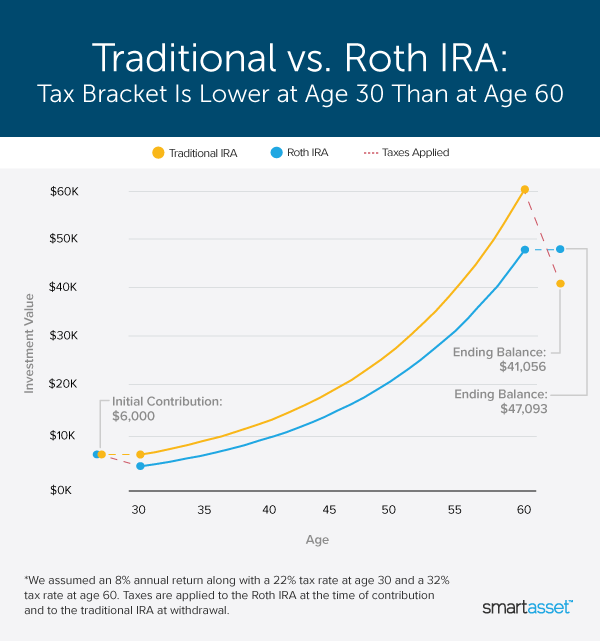

Roth Ira To Reduce Taxable Income

Earnings in a Roth account can be tax-free rather than tax-deferred. So, you can't deduct contributions to a Roth IRA. However, the withdrawals you make during. Yes, saving for the future can help you trim today's tax bill. Every dollar you contribute to an eligible retirement account reduces the amount of income that. IRAs are another way to save for retirement while reducing your taxable income. Depending on your income, you may be able to deduct any IRA contributions on. Converting a traditional IRA to a Roth IRA typically means paying significant taxes, but making a charitable contribution can help offset that income. This. When you convert your tax-deferred accounts to a Roth IRA, you are paying your income taxes in a lower tax bracket today so you can receive tax-free income. Both the contributions you make on a pre-tax basis and on a Roth contribution basis will count towards this maximum. Unlike Roth IRAs, income limits don't apply. 1. Contribute to a Health Savings Account (HSA) · 2. Make the most of deductions that reduce your AGI · 3. Reduce any income from self-employment · 4. Manage taxes. Because your contributions are included in your normal income the year you contribute, you can withdraw your contributions (but not your earnings) tax-free and. An SEP-IRA will reduce your taxable self-employment income, and hence the amount of tax you'll owe on that income. But since it's similar to. Earnings in a Roth account can be tax-free rather than tax-deferred. So, you can't deduct contributions to a Roth IRA. However, the withdrawals you make during. Yes, saving for the future can help you trim today's tax bill. Every dollar you contribute to an eligible retirement account reduces the amount of income that. IRAs are another way to save for retirement while reducing your taxable income. Depending on your income, you may be able to deduct any IRA contributions on. Converting a traditional IRA to a Roth IRA typically means paying significant taxes, but making a charitable contribution can help offset that income. This. When you convert your tax-deferred accounts to a Roth IRA, you are paying your income taxes in a lower tax bracket today so you can receive tax-free income. Both the contributions you make on a pre-tax basis and on a Roth contribution basis will count towards this maximum. Unlike Roth IRAs, income limits don't apply. 1. Contribute to a Health Savings Account (HSA) · 2. Make the most of deductions that reduce your AGI · 3. Reduce any income from self-employment · 4. Manage taxes. Because your contributions are included in your normal income the year you contribute, you can withdraw your contributions (but not your earnings) tax-free and. An SEP-IRA will reduce your taxable self-employment income, and hence the amount of tax you'll owe on that income. But since it's similar to.

You can deduct any Traditional IRA contributions you make for the year on your income tax return. Those contributions directly reduce your taxable income. For. Unlike traditional IRAs, Roth IRAs offer tax-free withdrawals, as contributions are made with after-tax dollars. · Tax-free income maximizes retirees' spending. Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth IRA, however all future. Want to save after-tax dollars in a. Roth IRA but your earnings exceed the Roth IRA income limitations. limit the contribution amount to a Roth IRA. You. One of the benefits of a Roth IRA is the abili- ty to bequeath those dollars on a tax-free basis. If your heirs' income tax rates fall into the lower brackets. If you are single, you must have a modified adjusted gross income (MAGI) under $, to contribute to a Roth IRA for the tax year, but contributions are. For federal tax purposes, contributions to a Roth IRA are different than contributions to a traditional IRA in that the contributions to a Roth IRA are not. While Roth IRAs don't lower your taxes when you contribute, they allow your money to grow tax-free indefinitely. Eliminating the taxes from your earnings can. While IRAs are often touted for the tax-deferred growth of the investments within the account, traditional IRAs may also provide a helpful tax deduction. If your adjusted gross income is $36, or less ($73, or less if married filing jointly), you could receive a tax credit up to $1, ($2, if married. With a Roth IRA, your contribution isn't tax-deductible the year you make it, but your money can grow tax-free and your withdrawals are tax-free in retirement. Roth IRA. Contributions are never tax-deductible. SELF-. Your contributions to a traditional IRA may also be tax-deductible, depending on your income, filing status and whether or not you have an employee-sponsored. Contributions: Contributions to an individual retirement arrangement (IRA) may be taken as an adjustment to income, the same as for federal tax purposes. This may reduce your taxable income for the year in which you've contributed to your IRA, therefore reducing the amount of tax you pay that year. When you. Unlike traditional IRAs, Roth IRAs offer tax-free withdrawals, as contributions are made with after-tax dollars. · Tax-free income maximizes retirees' spending. Qualified withdrawals from a Roth IRA, however, are generally not included in your federal taxable income. So if you have both, you may want to carefully. Tip: Holding some of your retirement savings in Roth accounts can help you limit how much income tax you'll owe in a given year. With a traditional IRA, you're able to make contributions with pre-tax dollars, reducing your taxable income for that year by the amount you contribute. However. The money you donate is not deductible, but it's not subject to federal taxes, qualifies as your RMD for the year, and you can use one even if you don't itemize.

Silver Spot Price Futures

1 Troy Ounce ≈ 1, Ounce, Silver Price Per 1 Ounce, USD ; 1 Troy Ounce ≈ 0, Kilogram, Silver Price Per 1 Kilogram, USD. Get free Comex Silver Tips. Comex Live Silver prices and charts. Comex Silver International. Commodities; Indices; Futures; Currencies. Commodities, Last, Chg. Silver CVOL Index Compare charts of current implied volatilities across expirations to the view from one week earlier. SI.1 | A complete Silver (NYM $/ozt) Front Month futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures. Stay up to date with real-time silver spot prices, available in troy ounces (oz), kilos and grams. Browse historical silver prices with interactive charts and. Silver Price Charts · Silver in US Dollar · Silver Price Guide · Spot Price for Silver · Futures Price for Silver · The London OTC Silver Price · COMEX · LBMA Silver. Find the latest Silver Dec 24 (SI=F) stock quote, history, news and other vital information to help you with your stock trading and investing. We predict $48 to be hit either by mid or mid” JP Morgan “The Fed cutting cycle and falling U.S. real yields are expected to push gold prices to new. Get the latest Silver price (SI:CMX) as well as the latest futures prices and other commodity market news at Nasdaq. 1 Troy Ounce ≈ 1, Ounce, Silver Price Per 1 Ounce, USD ; 1 Troy Ounce ≈ 0, Kilogram, Silver Price Per 1 Kilogram, USD. Get free Comex Silver Tips. Comex Live Silver prices and charts. Comex Silver International. Commodities; Indices; Futures; Currencies. Commodities, Last, Chg. Silver CVOL Index Compare charts of current implied volatilities across expirations to the view from one week earlier. SI.1 | A complete Silver (NYM $/ozt) Front Month futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures. Stay up to date with real-time silver spot prices, available in troy ounces (oz), kilos and grams. Browse historical silver prices with interactive charts and. Silver Price Charts · Silver in US Dollar · Silver Price Guide · Spot Price for Silver · Futures Price for Silver · The London OTC Silver Price · COMEX · LBMA Silver. Find the latest Silver Dec 24 (SI=F) stock quote, history, news and other vital information to help you with your stock trading and investing. We predict $48 to be hit either by mid or mid” JP Morgan “The Fed cutting cycle and falling U.S. real yields are expected to push gold prices to new. Get the latest Silver price (SI:CMX) as well as the latest futures prices and other commodity market news at Nasdaq.

Today's Silver prices with latest Silver charts, news and Silver futures quotes.

Stay updated with real-time charts of international precious metal prices. Track spot prices for Silver in USD, GBP, and EUR. Access live updates here >>. Silver Spot Price ; Change: ($) USD (%) ; High: ; Low: ; Silver Spot Price · Live Metal Spot Prices (24 Hours) Last Updated: 8/30/ Market Specifications. Trading Screen Product Name: Silver Daily Futures Minimum Price Fluctuation. One half cent ($) per fine troy ounce. Annual Closing Silver Prices and % Returns by Currency ; , , , , ; , , , , View the latest Silver Continuous Contract Stock (SI00) stock price, news, historical charts, analyst ratings and financial information from WSJ. “Global PV demand ( million ounces) is forecast to be 12% of total silver demand in Despite metal thrifting, which has already reduced silver content. Stay up to date with real-time silver spot prices, available in troy ounces (oz), kilos and grams. Browse historical silver prices with interactive charts and. The price of silver today, as of am ET, was $30 per ounce. That's up % from yesterday's silver price of $ Compared to last week, the price of. Annual Closing Silver Prices and % Returns by Currency ; , , , , ; , , , , Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Silver is expected to trade at USD/t. oz by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking. The current price of Silver Futures is USD / APZ — it has fallen −% in the past 24 hours. Watch Silver Futures price in more detail on the chart. Silver futures can allow investors and traders the ability to participate in the silver market without having to purchase or sell the raw material. Spot silver is currently priced at $17 per ounce, a silver dealer may list a basic silver round for sale at $ Silver Futures Contract Specifications ; Contract point value, 5, troy ounces, 1, troy ounces ; Minimum price fluctuation, ( * = $ per-. London Spot Silver Futures - Quotes ; SSPU · CT ; SSPU · CT ; SSPU · CT ; SSPU · CT. Silver futures are traded on the Tokyo Commodity Exchange (TOCOM). The CME silver futures contract calls for the delivery of 5, troy ounces of silver ( Since this applies to both foreign and domestic exchanges, the spot price of silver updates Sunday to Friday, 6pm EST until pm EST every day. The spot price. For , we continue to predict that silver will rise to 28 USD/oz which is a secular breakout level. Whether it will succeed in clearing secular resistance. The silver spot price market is open almost 24 hours per trading day, with a minute closed period each day between EST and 6 PM EST. The silver price.

Best Rated Private Student Loans

U.S. News experts have reviewed and ranked the top student loan companies in 14 different categories Best Private Student Loans · Best Student Loan Refinance. You should review your private loan contract carefully to better understand what rights you have. best deal and not losing out on any benefits in your current. Our experts' picks for the best student loans from reputable lenders include Ascent, Rhode Island Student Loan Authority, SoFi and five others. You can also compare lenders and their products side by side to determine the best private education loan for you. review your private education loan request. For more information on Federal Loan Forgiveness Possibilities review Each private lender may have a slightly different application process, so it is best to. Purefy helps you compare private student loans to find the best option for you. We've identified the top lenders offering low interest rates, flexible. One of them is Prodigy Finance which offers student loans for international masters students without collateral and cosigner. Try visiting their. Other perks, such as credit score tracking; Lender ratings and customer service track records. How to get a private student loan. Best for flexible repayment terms: College Ave · Best for low rates: Sallie Mae · Best for applying without a co-signer: Ascent · Best for fair credit: Earnest. U.S. News experts have reviewed and ranked the top student loan companies in 14 different categories Best Private Student Loans · Best Student Loan Refinance. You should review your private loan contract carefully to better understand what rights you have. best deal and not losing out on any benefits in your current. Our experts' picks for the best student loans from reputable lenders include Ascent, Rhode Island Student Loan Authority, SoFi and five others. You can also compare lenders and their products side by side to determine the best private education loan for you. review your private education loan request. For more information on Federal Loan Forgiveness Possibilities review Each private lender may have a slightly different application process, so it is best to. Purefy helps you compare private student loans to find the best option for you. We've identified the top lenders offering low interest rates, flexible. One of them is Prodigy Finance which offers student loans for international masters students without collateral and cosigner. Try visiting their. Other perks, such as credit score tracking; Lender ratings and customer service track records. How to get a private student loan. Best for flexible repayment terms: College Ave · Best for low rates: Sallie Mae · Best for applying without a co-signer: Ascent · Best for fair credit: Earnest.

Private Student Loans. However, for those students who are ineligible for For example, the most popular private option is a student line of credit. Private student loans are a great way to fill the funding gaps after scholarships, grants, and financial aid have been exhausted. Learn more about this. There are many private financial institutions, banks, and credit unions that offer student loans. To review a list of private lenders we have curated that. Over 6, reviews and a star rating · US News named us one of the Best Loan Companies for private student loans · Over , clients trust Earnest · Trusted. See current private student loan rates and explore Bankrate's expert picks for the best private student loans to help pay for college. Federal student loans usually have more benefits than private loans. Types Your servicer has several options available to help you keep your loan in good. Federal student loans: Best overall · SoFi: Best for member benefits · ISL: Best for no-cosigner loans · Pros · Cons · What is the best loan for a student to take. best interest rate possible. Cosigners can pre-qualify to determine their eligibility and available interest rates with no impact to their credit score. Review. Ascent Funding is a private loan organization that puts students first by providing student loans for college and consumer loans for bootcamps. The Best Student Loan Rates ; College Ave Student Loans. Variable rates as low as: % APR · Fixed rates as low as: % APR ; Sallie Mae Private Student Loans. Earnest is our top pick for all-around best lender due to its unparalleled range of loan options and its low rates. However, if finding the absolute lowest. Sallie Mae Student loans offers a variety of different loans for both undergraduate and graduate students, but this lender is especially great for graduate. Every family is different; as is every circumstance. The best guidance we can offer is to take your time and do your homework before borrowing any loan. Federal. Ascent is a private student loan program geared towards helping more students with limited income or credit history qualify for loans. Ascent is administered by. Sallie Mae® – Graduate Student Loans. Get the money you need to pay for your graduate degree or post-graduate studies. Apply once to get money for the whole. Discover How Navient Makes Things Easier. From our highly-rated student loans to our public and private sector business processing solutions, we help our. A Parent Student Loan is a great alternative to the federal PLUS loan. The private student loan benefits that we encourage the borrower to review. If you're unsure of where to start, use this guide to student loans and learn how to apply for federal, provincial and private loans. student, review the. While private student loans are considered a last resort for all borrowers, if you intend to go that route, it is wise to improve your credit score before.

Average Tax Rate In Retirement

Between $32, and $44,, you may have to pay income tax on up to 50% of your benefits. · More than $44,, up to 85% of your benefits may be taxable. * The % Medicare tax will apply to the lesser of your net investment income or the amount of adjusted gross income in excess of the applicable threshold. Net. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the rest is tax-free. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical. MTR Illustrator ; Marginal tax rate, % ; Average tax rate ($90, divided by $,), % ; Taxable income, $, ; Total taxes, $90, The amount of income tax we deduct from your monthly pension payment depends on where you live. Each province and country has its own tax rate. We use the tax. Tax Brackets for ; 10%, Up to $11,, Up to $23, ; 12%, $11, to $47,, $23, to $94, ; 22%, $47, to $,, $94, to $, ; 24%. Registered Retirement Savings Plan (RRSP) contributions, self-employment That's different from the average tax rate, which compares your total tax. If you're in a higher tax bracket (32%, 35%, or 37%), there's a good possibility your tax rate in retirement will be the same as or lower than it is today, so. Between $32, and $44,, you may have to pay income tax on up to 50% of your benefits. · More than $44,, up to 85% of your benefits may be taxable. * The % Medicare tax will apply to the lesser of your net investment income or the amount of adjusted gross income in excess of the applicable threshold. Net. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the rest is tax-free. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical. MTR Illustrator ; Marginal tax rate, % ; Average tax rate ($90, divided by $,), % ; Taxable income, $, ; Total taxes, $90, The amount of income tax we deduct from your monthly pension payment depends on where you live. Each province and country has its own tax rate. We use the tax. Tax Brackets for ; 10%, Up to $11,, Up to $23, ; 12%, $11, to $47,, $23, to $94, ; 22%, $47, to $,, $94, to $, ; 24%. Registered Retirement Savings Plan (RRSP) contributions, self-employment That's different from the average tax rate, which compares your total tax. If you're in a higher tax bracket (32%, 35%, or 37%), there's a good possibility your tax rate in retirement will be the same as or lower than it is today, so.

Income Tax on Taxable Income: Low of 2% (on up to $10, for single filers and $20, for joint filers) and a high of % (on more than $, for single. Investments;; Retirement Assistance Programs;; U.S. Tax;; Estate Planning;; Deceased Persons;; Social Programs and Benefits. highest marginal tax rate. This makes interest the least tax-efficient form Keys to tax-efficient retirement. GETTING READY TO RETIRE. An effective. If you're age 55 or younger · taxable — taxed at your marginal tax rate. The highest rate of tax a taxpayer will pay on their income. Find out your marginal tax. Tax on Taxable Income: Low of % (on up to $20, for single filers and $41, for joint filers) and a high of % for taxable income exceeding those. Between $32, and $44,, you may have to pay income tax on up to 50% of your benefits. More than $44,, up to 85% of your benefits may be taxable. Are. percent federal income tax withholding. The payment is taxed in the year in You can find more information about the taxation of payments from qualified. Wages are taxed at normal rates, and your marginal state tax rate is %. retirement benefits from taxation, all other forms of retirement income are. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. For each bracket, the second number is the maximum for that tax rate and the first number in the next bracket is over the highest amount for the previous rate. In the remaining states, total state and average local tax rates range up to %. Tennessee and Louisiana tie for the highest average sales tax rates in the. Determine How Social Security Will Be Taxed · Between $25, and $34,, you may have to pay income tax on up to 50 percent of your benefits. · More than. Sales of Stocks, Bonds, and Mutual Funds: Long-term gains (held over a year) are taxed at 0%, 15%, or 20% capital gains tax rates, based on income thresholds. Generally, the higher that total income amount, the greater the taxable part of your benefits. This can range from 50 to 85 percent depending on your income. Long-term investment gains, including qualified dividends, are taxed at the long-term capital gains rate (plus a potential % net investment income tax). Federal income tax rates ; 12%, $10, to $41,, $14, to $55, ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to. If you are retired or planning to retire, this guide answers common questions regarding retirement income and how to report it on your. New Jersey Income Tax. pension and eligible retirement income (whichever is less). Delaware has a graduated tax rate ranging from % to % on income under $60, Income tax rates for The income tax rates for the taxation year pensions Support Payments · multimedia Press Room · file Government Mass. Sales Tax Rate Lookup · Grocery Tax · Sales Tax Exemptions · Accelerated Sales Tax Virginia Department of TaxationAn official website of the Commonwealth.

Dietary Supplement For Hair Loss

Viviscal Hair Growth Supplements is a clinically proven solution for those suffering from fine or thinning hair to achieve, thicker, fuller hair in as little. The total amount of Zinc in our Hair Growth and Anti Hair Loss is mg (this is the combined amount when taking both products). Are the products safe for. Other essential vitamins · Multivitamins: A multivitamin can supplement dietary sources of all of the essential vitamins. · Vitamin C: A symptom of vitamin C. HAIR THINNING ; PHYTOPHANÈRE Dietary Supplement - 4 Month Supply. $ ; PHYTOCYANE Revitalizing Scalp Serum For Temporary Hair Thinning. $ ; PHYTOPHANÈRE. Vitamin E also protects areas of the skin, like the scalp, from oxidative stress and damage. Damaged skin on the scalp can result in poor hair quality and fewer. EVERY PERSON'S HAIR CONDITIONS ARE UNIQUE. INDIVIDUAL RESULTS MAY VARY DEPENDING ON HAIR TYPE, CONDITIONS, AND USE. BONDIBOOST DOES NOT GUARANTEE SPECIFIC. Although there is no evidence to suggest that individual vitamins can encourage the hair to grow faster, deficiencies in specific vitamins can lead to hair. Best for replenishing nutrients for hair regrowth · Iron Helps boost circulation and carries oxygen to the roots of the hair, which allows the hair to grow. The #1 dermatologist-recommended hair growth supplements for men and women. % drug free, clinically proven using patented technology for visibly thicker. Viviscal Hair Growth Supplements is a clinically proven solution for those suffering from fine or thinning hair to achieve, thicker, fuller hair in as little. The total amount of Zinc in our Hair Growth and Anti Hair Loss is mg (this is the combined amount when taking both products). Are the products safe for. Other essential vitamins · Multivitamins: A multivitamin can supplement dietary sources of all of the essential vitamins. · Vitamin C: A symptom of vitamin C. HAIR THINNING ; PHYTOPHANÈRE Dietary Supplement - 4 Month Supply. $ ; PHYTOCYANE Revitalizing Scalp Serum For Temporary Hair Thinning. $ ; PHYTOPHANÈRE. Vitamin E also protects areas of the skin, like the scalp, from oxidative stress and damage. Damaged skin on the scalp can result in poor hair quality and fewer. EVERY PERSON'S HAIR CONDITIONS ARE UNIQUE. INDIVIDUAL RESULTS MAY VARY DEPENDING ON HAIR TYPE, CONDITIONS, AND USE. BONDIBOOST DOES NOT GUARANTEE SPECIFIC. Although there is no evidence to suggest that individual vitamins can encourage the hair to grow faster, deficiencies in specific vitamins can lead to hair. Best for replenishing nutrients for hair regrowth · Iron Helps boost circulation and carries oxygen to the roots of the hair, which allows the hair to grow. The #1 dermatologist-recommended hair growth supplements for men and women. % drug free, clinically proven using patented technology for visibly thicker.

Biotin is a water-soluble B-vitamin also known as vitamin H or coenzyme R. Biotin is a vitamin found typically in fish or pulses, and works to break down. Our hair growth vitamins and supplements make your hair thicker and stronger in 90 days with a blend of biotin, ashwagandha, and amino acids. Shop Now! Hair Growth Supplement - Promotes Hair Regrowth, Stops Hair Loss & Boosts Beard Growth with Biotin, Kelp, Bamboo & More for Skin, Nails & Hair (60 Capsules). Below, we have put together the top 7 of most important vitamins and minerals for healthy hair growth and prevention of hair loss. Nutrafol Women's Balance is the only hair growth supplement with published clinical studies in menopausal women with hair thinning. This formula is proven to. A biotin deficiency may lead to hair loss, and supplements may aid hair growth. However, evidence has not shown that biotin supplements can boost hair. Healthy Hair Growth Supplements may combat hair loss with DHT inhibiting botanicals plus Biotin, Niacin and Zinc for thicker, fuller looking hair. Shop Target for Hair Growth you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $ Nature's Bounty Advanced Hair, Skin and Nails Non-GMO Gummies with Biotin · $ ¢/ea. ; CVS Biotin Softgels, 60 CT · $ ¢/ea. ; Nature's. We have the best supplements for hair growth on the market today. Our selection of hair supplements will help with your beauty care regiment. NutraPro Thick Hair Growth Vitamins–Anti Hair Loss Supplements with DHT Blocker Stimulates Faster Hair Growth for Weak, Thinning Hair. out of 5 Stars. Viviscal Hair Growth Supplements is a clinically proven solution for those suffering from fine or thinning hair to achieve, thicker, fuller hair in as little. There's actually very little evidence hair loss vitamins work. In some cases, taking excessive vitamins, like Vitamin A can actually make hair loss worse. The ultimate beauty booster, biotin is an essential nutrient that helps support healthy hair, skin, and nails. Stimulates hair growth; Improves hair volume &. Explore The Vitamin Shoppe's large selection of hair supplements by popular brands to find the hair support you need. Biotin. Biotin (vitamin B7 or vitamin H) is used by your body to help make fatty acids. It's thought it can help stimulate the production of keratin, which is. Hair Supplements ; Nutrafol - WOMEN Clinically Proven Hair Growth Supplement for Thinning · NutrafolWOMEN Clinically Proven Hair Growth. Three of our most popular combined vitamin and mineral tablets for hair support are Starpowa Hair, Skin and Nail Gummies, Hairburst Heart Hair Vitamins. Improve the appearance of thinning or breakage-prone hair with hair renewal vitamins from Viviscal, Shen Min and RejuviCare that contain essential nutrients. Description. Viviscal Extra Strength hair vitamin supplements for women nourish thinning hair and promote existing hair growth from within.*. Viviscal.

Free Day Trading Books

1. Beginner's Guide to Day Trading Online by Toni Turner · 2. How to Day Trade for a Living by Andrew Aziz · 3. Mastering the Trade by John Carter · 4. How to Day. Best Day Trading Books · 8. Trading for a Living: Psychology, Trading Tactics, Money Management · 7. Think and Grow Rich · 6. Trading in the Zone: Master the. Throughout the course of this book, I will help you to get an even sharper edge in your trading, creating a trading strategy with an even higher winning. CFI's investing and trading book is free, available for anyone to download as a PDF. Read about the markets, trading concepts, and technical trading. The national bestseller—updated for the new stock market!"Read the book if you want to know how the market works and how to make it work for you. Stay informed: Monitor market headlines, economic reports, and other factors influencing stock and other asset prices throughout the day. · Pattern day trader. Allows you to read the intraday trading book as a PDF on any and all devices, even your phone. % free. Use the information you'll receive immediately. You will learn about all of those topics and more in this e-book. Day trading works by capitalizing on short-term price movements in a stock through the active. You will learn about all of those topics and more in this e-book. Day trading works by capitalizing on short-term price movements in a stock through the active. 1. Beginner's Guide to Day Trading Online by Toni Turner · 2. How to Day Trade for a Living by Andrew Aziz · 3. Mastering the Trade by John Carter · 4. How to Day. Best Day Trading Books · 8. Trading for a Living: Psychology, Trading Tactics, Money Management · 7. Think and Grow Rich · 6. Trading in the Zone: Master the. Throughout the course of this book, I will help you to get an even sharper edge in your trading, creating a trading strategy with an even higher winning. CFI's investing and trading book is free, available for anyone to download as a PDF. Read about the markets, trading concepts, and technical trading. The national bestseller—updated for the new stock market!"Read the book if you want to know how the market works and how to make it work for you. Stay informed: Monitor market headlines, economic reports, and other factors influencing stock and other asset prices throughout the day. · Pattern day trader. Allows you to read the intraday trading book as a PDF on any and all devices, even your phone. % free. Use the information you'll receive immediately. You will learn about all of those topics and more in this e-book. Day trading works by capitalizing on short-term price movements in a stock through the active. You will learn about all of those topics and more in this e-book. Day trading works by capitalizing on short-term price movements in a stock through the active.

stock markets, this book focuses mainly on trading stocks and currencies. A new trader should also try to use free services for stock news and charts. The Wiley Trading series features books by traders who have survived the market's ever changing temperament and have prospered—some by reinventing systems. Day Trading · From Understanding Risk Management and Creating Trade Plans to Recognizing Market Patterns and Using Automated Software, an Essential Primer in. This book will teach you all you need to know in order to make money with day trading, from general day trading principles, to deciding when to buy and sell. Here we present our complete selection of Trading Books: · A Practical Guide to Swing Trading · Constructing the best trading strategy: A new general framework. Free Day Trading Course · Day trading is a tough career. If you're new to the field of day trading, you need to learn and to be mentored by the best! · FREE Day. Digital Day Trading Howard Abell offers a great and sensible guide to day trading. His market philosophy and explanation of his trading psychology are. A comprehensive guide to day trading, with prescriptive information and actionable advice to help you achieve financial success. books that you can read to improve your intraday trading game. 1. Beginner's Guide to Day Trading Online. Author: Toni Turner. This book is for absolute. Check out our day trading book selection for the very best in unique or custom, handmade pieces from our guides & how tos shops. Best Day Trading Books for Beginners · Interactive Day Trading: Ultimate Trading Guide by Satish Gaire · Day Trading for Dummies by Ann C. Logue. Results · How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology · How to Day Trade. Explore our list of Online & Day Trading Books at Barnes & Noble®. Get your order fast and stress free with free curbside pickup. Free Forex Ebooks ; Performance-Driven Technology and Ultra-Low Spreads · plus ebook. Writer: FP Markets File Type: PDF ; Trading with PLUS · plus ebook. FREE Chart Guys Ebooks & Guides: Explore topics from risk management to trader psychology, and enhance your trading knowledge. How To Suck Less At Day Trading: The Ultimate No-Nonsense Guide For Retail Traders on Getting A Reach Around From The Markets. 2 Part Book Series Collection (". Listen Free to Advanced Day Trading Guide: Learn Secret Strategies on How You Can Day Trade Forex, Options, Stocks, and Futures to Become a SUCCESSFUL Day. Day Trading Books · How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology. Popular Day Trading Books: How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology. Enjoy a variety of Day Trade PDF books. Our search engine allows you to find the best Day Trade books online.

1 2 3 4