chemistry-oge-ege.ru

News

What Is A Vdr

A virtual data room (VDR), or simply a data room, is a secure virtual space that is used as a repository of a company's documents. Virtual data rooms enable. Is Box a VDR? No, Box is not a VDR. It's a cloud-based content management platform that provides businesses with secure storage, sharing. A virtual data room (sometimes called a VDR or Deal Room) is an online repository of information that is used for the storing and distribution of documents. A virtual data room (VDR) is an online environment that enables the secure sharing of highly confidential files from one organisation to multiple organisations. A virtual data room is a secure online repository for document storage and distribution used in the due diligence process of a merger or acquisition. A virtual data room (VDR) is a secure online repository used for the storage and distribution of digital files and documents. As the name suggests, a virtual data room, or a “VDR,” is an online database in which companies can store and share confidential information, usually used. According to Investopedia, a Virtual Data Room (VDR) is “a secure online repository for document storage and distribution. It is typically utilized during. A virtual data room is a secure online storage that allows companies to store their documents, and share them with clients, investors and company leadership. A virtual data room (VDR), or simply a data room, is a secure virtual space that is used as a repository of a company's documents. Virtual data rooms enable. Is Box a VDR? No, Box is not a VDR. It's a cloud-based content management platform that provides businesses with secure storage, sharing. A virtual data room (sometimes called a VDR or Deal Room) is an online repository of information that is used for the storing and distribution of documents. A virtual data room (VDR) is an online environment that enables the secure sharing of highly confidential files from one organisation to multiple organisations. A virtual data room is a secure online repository for document storage and distribution used in the due diligence process of a merger or acquisition. A virtual data room (VDR) is a secure online repository used for the storage and distribution of digital files and documents. As the name suggests, a virtual data room, or a “VDR,” is an online database in which companies can store and share confidential information, usually used. According to Investopedia, a Virtual Data Room (VDR) is “a secure online repository for document storage and distribution. It is typically utilized during. A virtual data room is a secure online storage that allows companies to store their documents, and share them with clients, investors and company leadership.

Secure data sharing - Startups often handle sensitive information like financials, IPs, legal docs, etc. A VDR provides a controlled space to share these. VDR providers specialize in data storage and sharing with a focus on security. To ensure the security of business document flow, they comply with the necessary. Virtual data room (VDR) software supports the secure storing, indexing, and sharing of confidential documents. VDRs offer collaboration tools and user analytics. FileCloud answers the need for secure file sharing and collaboration with a full-featured VDR experience that incorporates granular access, collaboration, and. Virtual data rooms (VDRs) are secure digital spaces for files and docs, useful for due diligence in mergers and acquisitions or other work. Virtual data rooms are secure spaces to store documents across industries. Discover the future of dealmaking with Datasite. Use this for techniques to select and create Virtual Data Rooms (VDRs) as well as VDR best practices for legal operations teams and legal departments to. What is virtual data room (VDR)?. A virtual data room is a secure online storage that allows companies to store their documents, and share them with clients. A VDR provides you with a centralised platform to manage the process of raising capital for your business, enabling you to control and share large volumes of. A virtual data room, also known as a VDR or electronic data room, is an internet-based, secure platform that serves as a centralized repository for a. A virtual data room (VDR) is an online data repository that businesses can use to share critical documents with external parties in a highly secure online. What is a virtual data room? A virtual data room (VDR) is a virtual space that acts much like a physical data room except that all data is hosted securely. A Virtual Data Room (VDR) is an online, secure repository for documents and data pertaining to legal transactions or proceedings, and business. What is a Virtual Data Room? A virtual data room (VDR), also called as a virtual deal room, is an online repository designed for the secure storage and. A virtual data room (VDR) allows organizations to securely send and store confidential documents during due diligence. Whether you are going through a. A virtual data room (VDR) is technology that allows companies to securely store their documents and grant different levels of document access. A VDR provides you with a centralised platform to manage the process of raising capital for your business, enabling you to control and share large volumes of. A virtual data room, or a “VDR,” is an online repository where companies store their important and confidential documents and other data. The vdR Group provides solutions and services for manufacturers, engineering companies, and owner-operators. The Group's practice areas include product. Modern virtual data room (VDR) technology doesn't just streamline due diligence at the beginning of a complex transaction—it also sets the stage for a more.

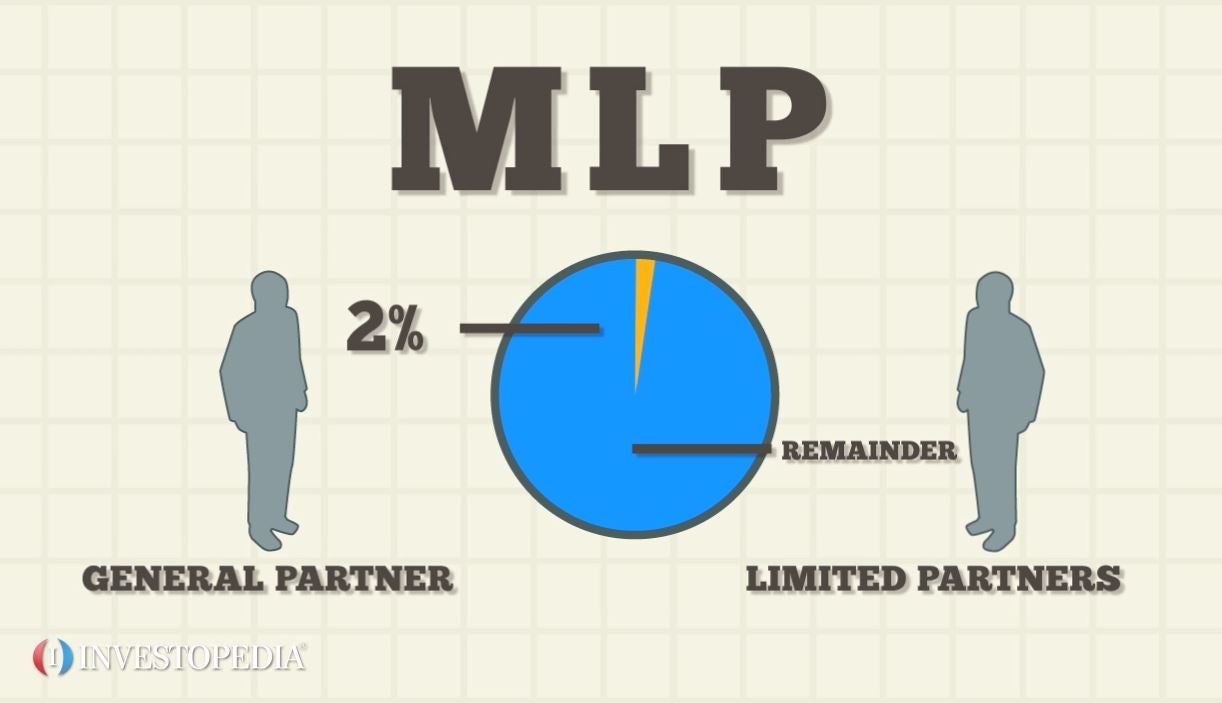

Mlp Partnership

A master limited partnership (MLP) is a unique investment that combines the tax benefits of a limited partnership (LP) with the liquidity of a common stock. Over the last 35 years, Master Limited Partnerships - commonly referred to as MLPs – have become a popular investment vehicle in the energy space. Master limited partnerships (MLPs) are entities that combine the tax benefits of a private partnership with the liquidity advantages of a stock. Formation, structure, implementation and unwinding of MLPs; Mergers, acquisitions, joint ventures and divestitures by and between MLPs; MLP initial public. What is a Master Limited Partnership (MLP)?. A master limited partnership (MLP) is a publicly-traded limited partnership that receives the tax benefits of. High-commission investments often fail to provide high-performance returns. If your MLP investment failed to perform well, you may have a legal claim against. In the United States, a master limited partnership (MLP) or publicly traded partnership (PTP) is a publicly traded entity taxed as a partnership. A master limited partnership receives the tax benefit features of a limited partnership, wherein the businesses are exempted from paying the corporate tax on. Master limited partnerships (MLPs) are limited partnerships (LPs) that trade publicly on a stock exchange. They provide investors with the best of both. A master limited partnership (MLP) is a unique investment that combines the tax benefits of a limited partnership (LP) with the liquidity of a common stock. Over the last 35 years, Master Limited Partnerships - commonly referred to as MLPs – have become a popular investment vehicle in the energy space. Master limited partnerships (MLPs) are entities that combine the tax benefits of a private partnership with the liquidity advantages of a stock. Formation, structure, implementation and unwinding of MLPs; Mergers, acquisitions, joint ventures and divestitures by and between MLPs; MLP initial public. What is a Master Limited Partnership (MLP)?. A master limited partnership (MLP) is a publicly-traded limited partnership that receives the tax benefits of. High-commission investments often fail to provide high-performance returns. If your MLP investment failed to perform well, you may have a legal claim against. In the United States, a master limited partnership (MLP) or publicly traded partnership (PTP) is a publicly traded entity taxed as a partnership. A master limited partnership receives the tax benefit features of a limited partnership, wherein the businesses are exempted from paying the corporate tax on. Master limited partnerships (MLPs) are limited partnerships (LPs) that trade publicly on a stock exchange. They provide investors with the best of both.

MLPs pay quarterly distributions. (similar to a dividend for a C corp) to both the general partner and limited partners based on the amount of distributable. What Is a Master Limited Partnership (MLP) Company? Illustration of three types of businesses in a row. A master limited partnership (MLP) company operates as. An MLP has one or more general partners that manage the partnership, and many limited partners, which provide capital to the partnership but have no role in its. partnerships (MLPs) and the definition of “qualifying income” for MLPs. We Treatment of an MLP as a partnership for federal income tax purposes. Empowering health organizations with expertise in integrating legal services. Adopt the medical-legal partnership approach to address social needs. What is the difference between an investment in units of a publicly traded master limited partnership (an MLP) and stock. It can be offset by other investment expenses. MLPs are also considered capital property for a step up in basis at death. This means whoever inherits the MLPs. MLPs are pass-through entities that are taxed as a partnership for federal income tax purposes, avoiding the double taxation of corporations (see Practice Note. Summary of S - th Congress (): Master Limited Partnerships Parity Act. The Master Limited Partnership Association (MLPA) is the nation's only trade association representing the publicly traded partnerships commonly known as master. A master limited partnership (MLP) is a limited partnership whose interests (known as “units”) are traded on public exchanges, just like corporate stock. PARTNERSHIP (MLP)?. Page 5. © Master Limited Partnership Association. Master Limited Partnerships • An MLP is a publicly traded partnership (PTP). How master limited partnerships work. An MLP is a business structure that is taxed as a partnership, but whose ownership interests are traded like corporate. As a result, MLPs may not be suitable for all clients. Characteristics of MLPs. An MLP is a form of publicly traded partnership and taxed as a partnership. An. What is a Master Limited Partnership (MLP)? Master limited partnerships (MLPs) can offer high dividend yields, steady cash flow, tax advantages, and the. How are partnerships, including. MLPs, taxed? Even though MLP investments are often referred to as stocks, they are in fact investments in a partnership. An MLP is a publicly-traded limited partnership that has at least one general partner and many limited partners. Limited partners are the owners of the MLP's. Traditional Master Limited Partnership (MLP) Investment- PAA Common Units. As an MLP, PAA is treated as a partnership for U.S. federal income tax purposes. Capex: shorthand for Capital Expenditures. Page 7. 3. Capital Account: the Capital Account maintained for a partner under the Partnership Agreement for an MLP. We offer legal services for Master Limited Partnerships (MLPs) and underwriters in essentially all the industries in which they operate.

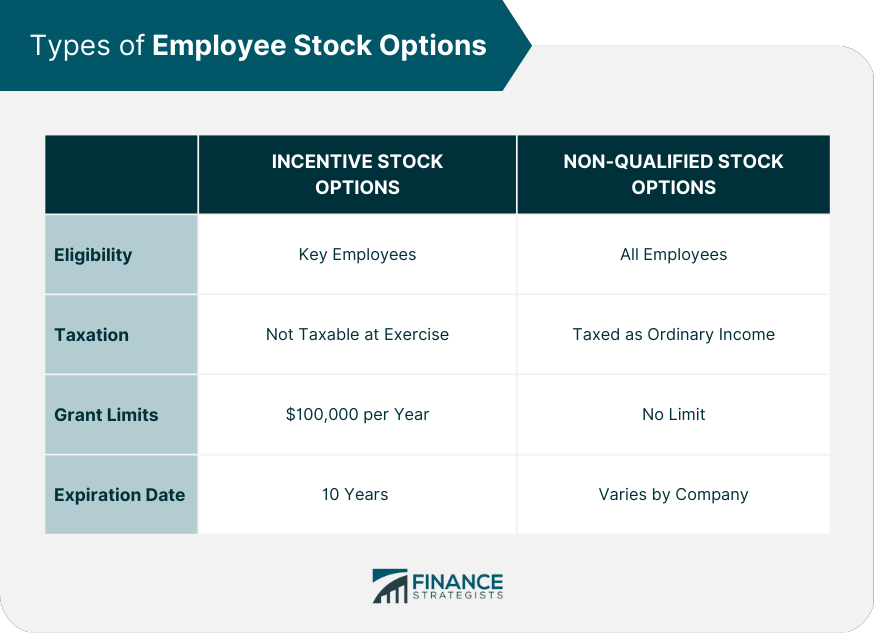

What Companies Offer Stock Options To Employees

Equity compensation is a desired benefit for various reasons: "Gives me a stake in the success of the company" (27%); "Helps meet long-term goals" (26%); ". Employee stock options, or ESOs, represent a contract between a company and its employees that gives employees the option to purchase shares of the company's. Stock-based compensation is offered routinely at tech start-ups to compensate for lower salaries. Along with company culture, stock options can motivate. Stock options give employees the right to buy a certain number of shares in the company at a fixed price, known as the grant price. That is usually the market. Many companies offer stock options to employees to boost compensation. Rather than granting shares directly, the employee receives a call option that gives. employee retention. An example of a stock option is a startup company offers its employees the option to buy company stock at the current market value price. Offering employees stock options can provide a way for companies to attract top executives and incentivize employees. Stock options are particularly popular. Employee stock options is a way to give equity (or ownership) in your company to employees. A slice of the cake, if you will. But, they also offer you even more ways to earn money. Many companies offer employees stock options. This allows employees to own part of the company. So. Equity compensation is a desired benefit for various reasons: "Gives me a stake in the success of the company" (27%); "Helps meet long-term goals" (26%); ". Employee stock options, or ESOs, represent a contract between a company and its employees that gives employees the option to purchase shares of the company's. Stock-based compensation is offered routinely at tech start-ups to compensate for lower salaries. Along with company culture, stock options can motivate. Stock options give employees the right to buy a certain number of shares in the company at a fixed price, known as the grant price. That is usually the market. Many companies offer stock options to employees to boost compensation. Rather than granting shares directly, the employee receives a call option that gives. employee retention. An example of a stock option is a startup company offers its employees the option to buy company stock at the current market value price. Offering employees stock options can provide a way for companies to attract top executives and incentivize employees. Stock options are particularly popular. Employee stock options is a way to give equity (or ownership) in your company to employees. A slice of the cake, if you will. But, they also offer you even more ways to earn money. Many companies offer employees stock options. This allows employees to own part of the company. So.

shares available for company executives to grant to their employees and other service providers. Most employees at a startup company are offered stock options. Stock options and restricted stock units (RSUs) are two types of equity compensation that companies offer their employees. To keep employees within the company (the main reason behind vesting schedules) stock option or equity offer. The question is: is this a good offer? Well. corporations to offer their employees financial incentives in lieu of higher salaries. Benefits from a stock option are generally included in the. Yes, any company can if they want to do it. Startup companies offer stock options as their primary appeal for joining. The stock does not have. Stock Options: “a benefit in the form of a stock option given by a company to an employee to buy stock in the company at a discount or at a stated fixed price.”. There are two ways a young company can grant equity: stock or stock options. Stock is direct ownership in the company, whereas stock options give an employee. Companies generally offer two types of stock options to their employees: non-qualified stock options (NQSOs) and incentive stock options (ISOs). From an. Employee stock options (ESOs) offer employees the chance to purchase company stock at a potentially reduced price—which can result in a tremendous windfall. employee compensation in which companies grant While restricted stock grants actual shares to employees with certain restrictions, stock options offer. Employers award stock grants to employees and provide them with the value of the corporate stock. Stock options allow an employee to purchase shares of the. Companies offer employee stock options (ESOs) to their employees and executives as a type of equity compensation. ESOs give the employee the right to buy. Usually companies offer RSUs (restricted stock units) or stock options such as NSOs and ISOs as equity to employees. This may depend on the company size. Employee stock options are commonly viewed as an internal agreement providing the possibility to participate in the share capital of a company, granted by the. No. Many private companies provide no equity. That makes them non-competitive in the typical situation of base salaries matching public. But, they also offer you even more ways to earn money. Many companies offer employees stock options. This allows employees to own part of the company. So, when. Stocks. A startup company may offer stock options to its employees. Stock options grant employees the right to purchase a number of stocks at an agreed-upon. ESOs are a form of equity compensation that your company can give to executives and other selected employees. However, ESOs differ from listed options on stocks. Stock compensation is a non-monetary payment to employees, providing them with shares or giving them the opportunity to buy shares as part of their. Vesting is the company's way of keeping you around. They don't just want to give you a piece of the company now—they want you to continue to have a VESTED.

Credit Cards With Rebates Cash Back

With a cash back credit card from Wells Fargo, you earn cash back in the form of cash rewards for purchases you make. Earn unlimited cash rewards on purchases. Get % cash back · Cash back credit card FAQs · Apply for your Cash Back credit card. 15 Best cash back credit cards for September · + Show Summary · Wells Fargo Active Cash® Card · Blue Cash Everyday® Card from American Express. Cash back is received in the form of Rewards Dollars that can be redeemed as a statement credit or for eligible items at chemistry-oge-ege.ru checkout. Welcome bonus. 15 Best cash back credit cards for September · + Show Summary · Wells Fargo Active Cash® Card · Capital One SavorOne Cash Rewards Credit Card · Citi. Credit card cash back rewards are bonuses provided to credit card customers when they use their cards to make purchases. Cash back credit cards from Bank of America allow you to earn cash rewards on all of your purchases. Apply online. This credit card from financial technology company SoFi offers 2% cash back on all spending if you deposit your rewards into a SoFi investment or banking. The best cashback credit card I know so far is Robinhood's Gold Visa card, which gives 3% cashback on everything without limit. They also. With a cash back credit card from Wells Fargo, you earn cash back in the form of cash rewards for purchases you make. Earn unlimited cash rewards on purchases. Get % cash back · Cash back credit card FAQs · Apply for your Cash Back credit card. 15 Best cash back credit cards for September · + Show Summary · Wells Fargo Active Cash® Card · Blue Cash Everyday® Card from American Express. Cash back is received in the form of Rewards Dollars that can be redeemed as a statement credit or for eligible items at chemistry-oge-ege.ru checkout. Welcome bonus. 15 Best cash back credit cards for September · + Show Summary · Wells Fargo Active Cash® Card · Capital One SavorOne Cash Rewards Credit Card · Citi. Credit card cash back rewards are bonuses provided to credit card customers when they use their cards to make purchases. Cash back credit cards from Bank of America allow you to earn cash rewards on all of your purchases. Apply online. This credit card from financial technology company SoFi offers 2% cash back on all spending if you deposit your rewards into a SoFi investment or banking. The best cashback credit card I know so far is Robinhood's Gold Visa card, which gives 3% cashback on everything without limit. They also.

% to 2%2 cash rebate on purchases made with your Visa Signature Cashback Rewards Credit Card; 1% cash rebate on purchases made with your Visa Traditional. You earn a full 2% Cashback Bonus® on your first $ in combined purchases at Gas Stations (stand-alone), and Restaurants each calendar quarter. Calendar. Best in Cash Back and No Annual Fee Credit Cards · Citi Double Cash® Card · Chase Freedom Unlimited® · Blue Cash Everyday® Card from American Express · Citi Custom. Wells Fargo Active Cash® Card: Best for Flat-rate cash back · Chase Freedom Unlimited®: Best for All-around cash back · Discover it® Cash Back: Best for Quarterly. Unlock financial rewards with our cash back credit cards. Spend smarter with Mastercard and earn cash back on your everyday purchases. Chase Freedom Flex®: Best Rotating Category Cash-Back Card · Citi Custom Cash® Card: Best Cash-Back Card With Changeable Bonus Categories · Prime Visa: Best Cash-. The Alliant Cashback Visa Signature card offers all cardholders unlimited % cashback with no annual fee – which is already a great value! Alliant members. Cash Back Credit Cards ; Citi Custom Cash® Card · 5% |or 1%Cash Back · Low intro APRon purchases & balance transfers · No annual fee ; Citi Double Cash® Card · Low. The Capital One Spark Cash Plus offers an unlimited 2% cash back on all purchases. It has a fairly high annual fee of $, but if you're moving a lot of. It's Not Free Cash. When merchants accept payment via credit card, they are required to pay a percentage of the transaction amount as a fee to the credit card. AT A GLANCE. Earn cash back for every purchase. Earn 5% cash back on up to $1, on combined purchases in bonus categories each quarter you activate. Cash back credit cards can be a great way to earn on your every day spending. Most cards let you redeem for statement credits, direct deposit, gift cards and. Best travel credit card for cash back: Chase Sapphire Preferred® Card. Despite rising competition, the Chase Sapphire Preferred® Card remains our favorite. You'll earn % cashback rewards for every $ in net purchases (purchases less returns) on your Huntington® Cashback Credit Card. Are there restrictions on. With the Key Cashback credit card, if you have an active KeyBank checking account, 1 you can earn up to 2% on every purchase—no categories, no limits. Every Capital One cash back credit card gives you a percentage back for all qualifying purchases—so you can get rewarded for every dollar you spend. CashBack earnings will be issued as an automatic rebate annually. Q: Who can use this? A: Anyone with a PrimeSouth Bank VISA credit card. Q: How do I enroll? A. Explore a world of cashback with our extensive network of partnered institutions! Currently offering a large set of credit card, bank account and retail. Chase Freedom Unlimited® Card Rating is based on the opinion of TPG's editors and is not influenced by the card issuer. Earn an extra % on everything you. Similar to a rebate or a refund, a cash-back credit card gives you money back for every purchase you make. These cards typically reward you a flat.

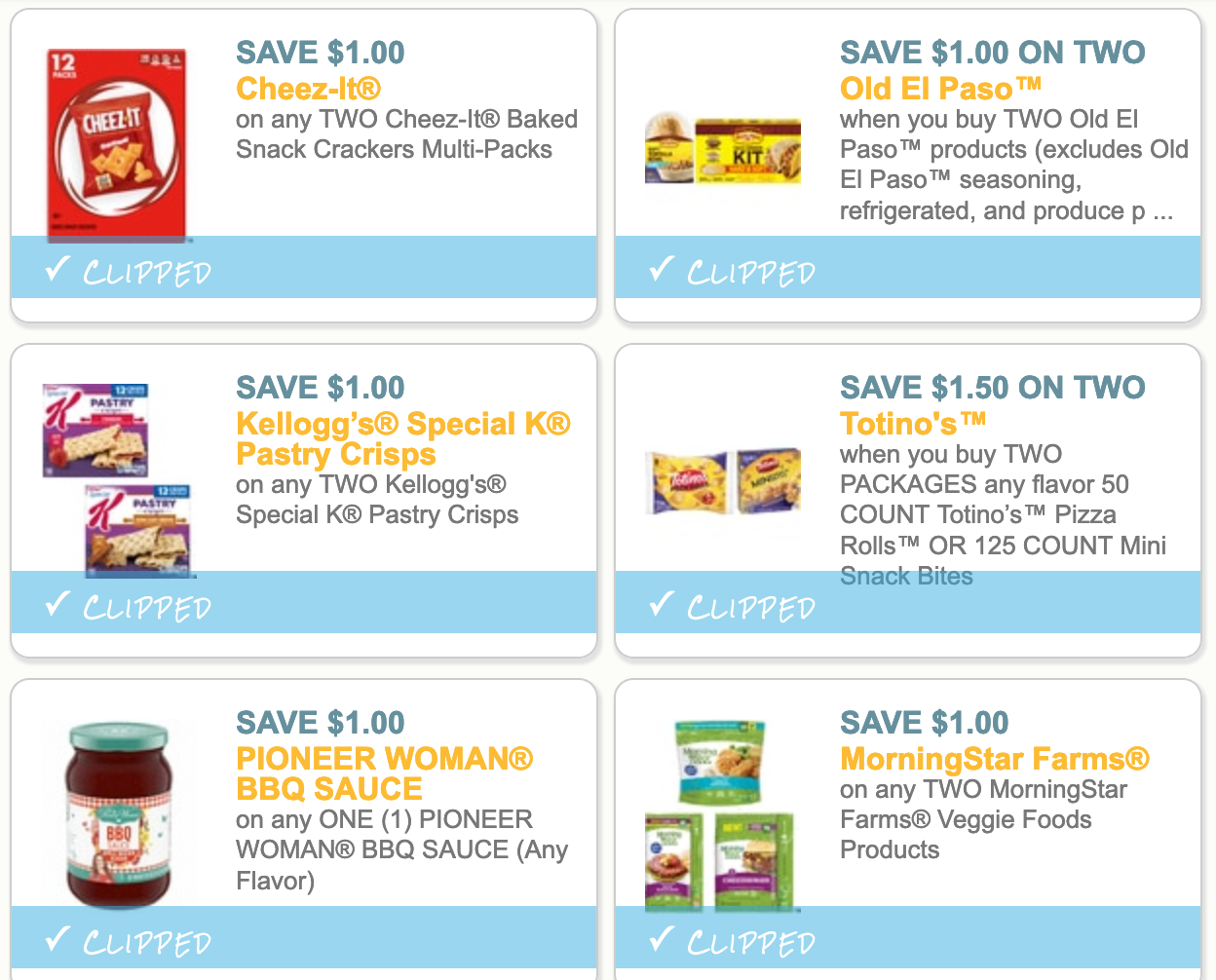

Best Way To Coupon For Groceries

You can use a pyramid method when couponing – you build a coupon upon a coupon to save. When done the right way, discovering how to stack coupons can go a long way to helping you save on your household and grocery bills. What's even more. Use coupon matching sites to help you discover the best deals at your favorite stores. Many coupon bloggers have specific lists of coupons. webSaver | It's worth the click! Welcome to webSaver's coupon page, this is where you will find coupons to help you save on the brand and products you use. Save on Food with the newest grocery coupon available. It's a great easy way to start saving money on your household staples such as bread, cereal, pasta. Extreme Couponing for the Not So Extreme – Series 1: Groceries We've all seen the episodes of the “extreme couponing” shows. People who dedicate their lives. 9 Tips for Better Couponing · 1. Utilize a Coupon Database · 2. Understand the Store's Coupon Policies · 3. Buy In Bulk · 4. Match Your Shopping List With Expiring. Couponing is not for the faint of heart; it takes time, dedication, and pretty much a dictionary of dos and don'ts to get through the grocery aisles unscathed. Best Stores to Coupon; How to Use Coupons at Curbside Grocery Pickup; How to Use Coupons with Grocery Delivery; How to Grocery Shop on a Budget, Even Without. You can use a pyramid method when couponing – you build a coupon upon a coupon to save. When done the right way, discovering how to stack coupons can go a long way to helping you save on your household and grocery bills. What's even more. Use coupon matching sites to help you discover the best deals at your favorite stores. Many coupon bloggers have specific lists of coupons. webSaver | It's worth the click! Welcome to webSaver's coupon page, this is where you will find coupons to help you save on the brand and products you use. Save on Food with the newest grocery coupon available. It's a great easy way to start saving money on your household staples such as bread, cereal, pasta. Extreme Couponing for the Not So Extreme – Series 1: Groceries We've all seen the episodes of the “extreme couponing” shows. People who dedicate their lives. 9 Tips for Better Couponing · 1. Utilize a Coupon Database · 2. Understand the Store's Coupon Policies · 3. Buy In Bulk · 4. Match Your Shopping List With Expiring. Couponing is not for the faint of heart; it takes time, dedication, and pretty much a dictionary of dos and don'ts to get through the grocery aisles unscathed. Best Stores to Coupon; How to Use Coupons at Curbside Grocery Pickup; How to Use Coupons with Grocery Delivery; How to Grocery Shop on a Budget, Even Without.

LOZO lists more than Grocery Coupons, All in One Place! It's never been easier to find and print your favorite coupons. Pretty much the only good thing about physical spam mail nowadays are flyers! The trick here with using these to save money on groceries without coupons is to. Flipp is your ultimate grocery savings and price matching tool. Simplify your shopping routine and save an average of $46 per week on food and more. A coupon is the same as cash. For example, if you have a $ off coupon on a box of cereal, the cashier takes the coupon as though it were cash. To begin your coupon hunt, plan your weekly meals around sale products if possible. That helps you find discounts without even having to coupon. To find in-. As you walk the aisles, there's a strategy you can use to save an average of 33% on your entire purchase. It doesn't require any coupon clipping or rewards. Want to Know How to Coupon for Groceries? Look in These 32 Places for the Best Coupons. One of the top rules in couponing is to never pay full price for your. Purchase coupons. If you know you are definitely going to make use of a coupon, buying it for less than its face value can be a good way to save money. Save on the brands that are helping us do good. Coupon exclusively on Walmart Canada app. Redeemable only through self-checkout in-store or online for. You can save 25% on your groceries if you buy generic brand groceries instead of name brands. Sometimes generic brands don't taste as good as brand names, but. 16 Brilliant Ways To Get the Best Deals at the Grocery Store Every Time · Seek Out Manager Markdowns · Always Buy Generic — Seriously · Shop on Wednesdays · Figure. Don't forget to check for coupon inserts in newspapers or use coupon databases to find the best deals. Make sure you have a way to keep your. Extreme Couponing for the Not So Extreme – Series 1: Groceries We've all seen the episodes of the “extreme couponing” shows. People who dedicate their lives. Coupon apps for grocery shopping you must try out · Cellfire (Android, Apple, BlackBerry) · chemistry-oge-ege.ru (Android, Apple) · Grocery IQ (Android, Apple) · Saving Star. Pay with a grocery rewards card. Using the right credit card at checkout can help you earn rewards that can be used to offset your bill. While a generic cash. The best way to find a coupon for couponing is online. You will be able to quickly compare all the coupons you find and choose which ones to use. Make sure. It is always a good idea to double check the important information on your coupon before heading to the store. Ensure the expiry date, product description &. Save on our favorite brands by using our digital grocery coupons. Add coupons Top Ways to Save This Week's Best Deals Boost Membership Free Digital. In-store coupon booklets: Always, always, always grab a coupon booklet when you enter the grocery store. Typically, these booklets will list items that are on. Couponing is not for the faint of heart; it takes time, dedication, and pretty much a dictionary of dos and don'ts to get through the grocery aisles unscathed.

How Does A Zelle Account Work

Zelle®: A fast and easy way to send money · There are no fees to send or receive money in our app · Money moves directly to their account in minutes · You only. HOW DOES ZELLE WORK? When you enroll with Zelle through your online banking account or mobile app, your name, the name of your financial institution, and the. All you need is your recipient's email address or U.S. mobile phone number and money will be sent directly from your account to theirs in minutes. If your bank or credit union offers Zelle® - You can send money to people you know and trust with a bank account in the U.S.. If your bank or credit union does. You can send, request, or receive money with Zelle. After you've enrolled, simply add your recipient's email address or US mobile number. U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes. Check with your financial. Zelle® is a fast, safe and easy way to send and receive money with friends, family and others you trust. Look for Zelle® in your banking app to get started. How Does Zelle® Work: When you enroll with Zelle®, your name, your financial Your bank or credit union then directs the payment into your bank account, all. Zelle is a fast, safe and easy way to send money to, and receive money from, people and eligible small businesses you know and trust who have a bank account in. Zelle®: A fast and easy way to send money · There are no fees to send or receive money in our app · Money moves directly to their account in minutes · You only. HOW DOES ZELLE WORK? When you enroll with Zelle through your online banking account or mobile app, your name, the name of your financial institution, and the. All you need is your recipient's email address or U.S. mobile phone number and money will be sent directly from your account to theirs in minutes. If your bank or credit union offers Zelle® - You can send money to people you know and trust with a bank account in the U.S.. If your bank or credit union does. You can send, request, or receive money with Zelle. After you've enrolled, simply add your recipient's email address or US mobile number. U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes. Check with your financial. Zelle® is a fast, safe and easy way to send and receive money with friends, family and others you trust. Look for Zelle® in your banking app to get started. How Does Zelle® Work: When you enroll with Zelle®, your name, your financial Your bank or credit union then directs the payment into your bank account, all. Zelle is a fast, safe and easy way to send money to, and receive money from, people and eligible small businesses you know and trust who have a bank account in.

If your customer uses Zelle® through their financial institution, they can send payments directly to your U.S. Bank account. Simply provide them with your email. Zelle is a fast, safe, and easy way to send money directly between almost any bank account in the US, typically within minutes. How Does Zelle Work? Zelle uses the Zelle Network to transfer money from over member banks and credit unions. Enrollment to the Zelle app is easy. Just. Enter the amount you want to send. If your recipient is already enrolled with Zelle®, the money will go directly into their bank account, typically in minutes. Zelle is a money transfer service that allows you to send and receive money in a matter of minutes. The app doesn't charge any fees and can be a convenient. All you need is your recipient's email address or U.S. mobile phone number and money will be sent directly from your account to theirs in minutes. Zelle® / Frequently asked questions · U.S. checking or savings account required to use Zelle®. · Payment requests to persons not already enrolled with Zelle® must. Zelle is an easy way to send money directly between almost any US bank accounts typically within minutes. Zelle is a mobile payment app that simplifies the payment process and allows for domestic peer-to-peer transfers to happen within minutes. If you're already enrolled with Zelle®, you don't need to do anything to receive money--payments will move directly into the checking account associated with. How to enroll with Zelle® at U.S. Bank · Go to your U.S. Bank Mobile App or online banking. · Provide your contact information. · Connect your account to Zelle®. How it works: ; Fast. Send and receive money in minutes while keeping your account information private. ; Easy. All you need is a U.S. bank account and a U.S. How Does Zelle® Work: When you enroll with Zelle®, your name, your financial Your bank or credit union then directs the payment into your bank account, all. How Does Zelle Work? Zelle lets users send money from their bank accounts to another person's account. This happens instantly even if the sender and receiver. Zelle is a fast, safe and easy way to send money directly between almost any bank accounts in the US, typically within minutes. It's a fast and easy way to send and receive money with people you know and trust who have a bank account in the U.S.. More than 1, banking apps in the U.S. Zelle is a person-to-person payment service that allows you to send and receive money directly from your bank account using an email address or mobile number. How does Zelle® work? When you enroll with Zelle® through the Fifth Third Bank app, your name, the name of your bank/credit union, and the email address or. The money will move directly into your bank account associated with your profile, typically within minutes1. work as you expect it to. Because we. Zelle® allows you to send or receive money among peers, typically in a matter of minutes.1; Funds are sent directly from your bank account to the recipient's.

Best Bank For Recent Graduates

As one of the world's leading financial institutions and a great place to work, Bank of America can be invaluable for young professionals that are currently. Wells Fargo. As a college student, establishing healthy money habits, including learning how to create a budget, using tools to help you stay on track, and. Best Overall: Chase Bank College Checking Account · Best For High School Students: Capital One MONEY Account · Best For Encouraging Saving: Bank of America. dedicated people from around the globe. We believe that everyone belongs in banking. Learn More. Search & Apply for Jobs. Search. Best Overall: Chase Bank College Checking Account · Best For High School Students: Capital One MONEY Account · Best For Encouraging Saving: Bank of America. Choose between two student bank account options ideal for college and high school students or teens Best for. 13 - 24 year olds; Teens and high school. Bank of America Advantage SafeBalance Banking® provides a straightforward, easy-to-use experience that lets you focus on the basics. Our research community includes economists from top economic departments and major institutions, referees and journal editors. You will have many. Capital One Money Teen Checking Account · Chime® Checking Account · Alliant Credit Union High-Rate Checking · Bank of America Advantage SafeBalance Banking® · USAA. As one of the world's leading financial institutions and a great place to work, Bank of America can be invaluable for young professionals that are currently. Wells Fargo. As a college student, establishing healthy money habits, including learning how to create a budget, using tools to help you stay on track, and. Best Overall: Chase Bank College Checking Account · Best For High School Students: Capital One MONEY Account · Best For Encouraging Saving: Bank of America. dedicated people from around the globe. We believe that everyone belongs in banking. Learn More. Search & Apply for Jobs. Search. Best Overall: Chase Bank College Checking Account · Best For High School Students: Capital One MONEY Account · Best For Encouraging Saving: Bank of America. Choose between two student bank account options ideal for college and high school students or teens Best for. 13 - 24 year olds; Teens and high school. Bank of America Advantage SafeBalance Banking® provides a straightforward, easy-to-use experience that lets you focus on the basics. Our research community includes economists from top economic departments and major institutions, referees and journal editors. You will have many. Capital One Money Teen Checking Account · Chime® Checking Account · Alliant Credit Union High-Rate Checking · Bank of America Advantage SafeBalance Banking® · USAA.

The Deutsche Bank Graduate Programme is a year-long comprehensive programme designed to provide you with exposure to a range of fascinating projects. Take our quick skills quiz to find which of our programmes suit you best. UK Global Banking & Markets Graduate Insight Programme · UK Insight Programme. USAA (military + family only), Schwab, Ally or Capital One All are online banks that aren't designed to generate income in the form of fees. 6 Best Banks for College Students · 1. Chime: Best Overall · 2. Chase College Checking: Best Sign-Up Bonus · 3. Capital One Money: Best for Students under The HSBC Graduate Bank Account is a great option, offering an interest-free overdraft of up to £3, for the first year after graduation. Plus, it's possible. Our review. The HSBC Graduate Bank Account is a great option, offering an interest-free overdraft of up to £3, for the first year after graduation. College graduates are half as likely to be unemployed as their peers whose highest degree is a high school diploma. Typical earnings for bachelor's degree. In Are Recent College Graduates Finding Good Jobs?, Abel and Deitz examine Federal Reserve Bank Seal. Young Women in Tech ; Citizenship. Be a citizen of a Bank member country. ; Availability. To work full-time within predefined dates. ; Laboratoria graduate. Have. Learn more about job opportunities for early career students and graduates in North America (NAM) top global Commodities bank. Our capabilities. Bank on your future with a Chase College Checking account. Earn up to $ when you open a new account. Join a company offering the best international internships and recent graduate programmes and become part of a great project for your professional growth. Go to. finance entry level recent college graduates jobs · Universal Banker (Personal Banker) - Lahaina · $21 - $24 · Entry-Level Financial Representative · $60, -. As college students graduate and start their careers, financial responsibility should be a top priority. ABA has identified six traps that could hinder new. Financial Analyst · Investment Banking Analyst · Accountant · Tax Associate · Financial Planning Associate · Insurance Agent · Credit Analyst · Mortgage Loan Officer. Bank Street College works to improve the quality of education for children and teachers and help all students reach their full potential. candidates and recent Ph.D. graduates who are Sub-Saharan Africa nationals. TRE Summer Internship for College Students The World Bank Treasury Summer. Bank, Account name, Monthly fee ; Chase, Chase College Checking Account, $6 a month, but this is waived for up to five years of college enrolment ; Bank of. With a variety of program areas, student trainee positions, and entry-level career options, the NIH seeks the best and brightest students and recent graduates. Whether you are looking for your first internship or a full-time opportunity as a college graduate, we have many options to help develop your career.

3 4 5 6 7