chemistry-oge-ege.ru

Tools

What Does Volatility Mean In Stocks

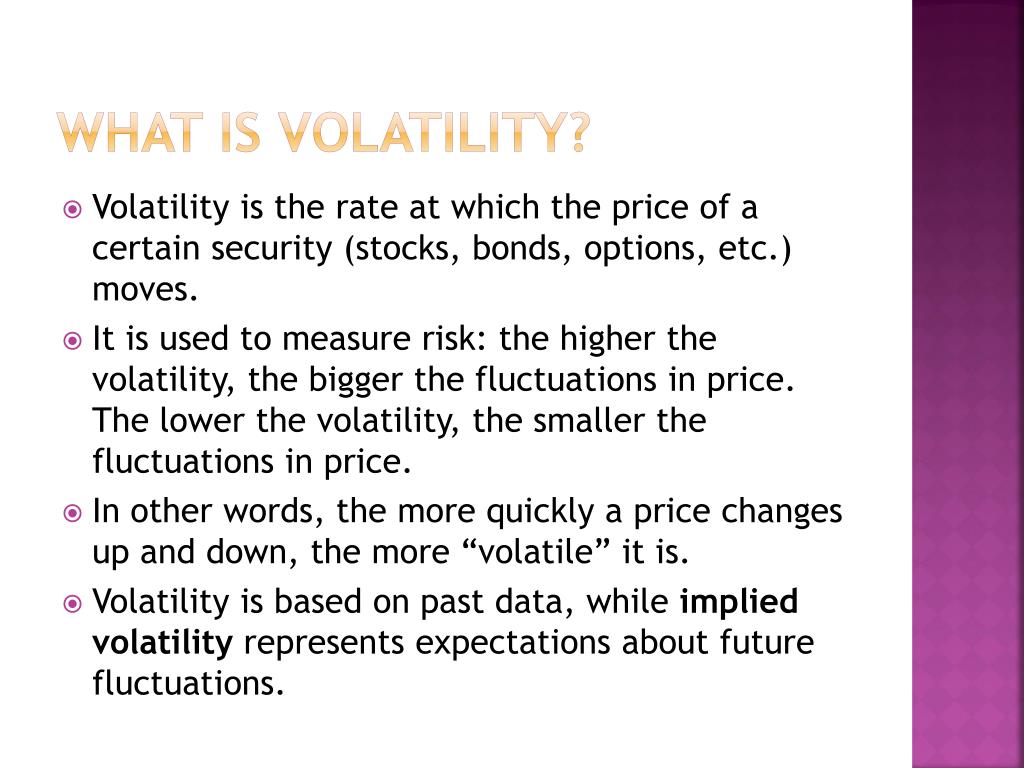

Financial market volatility is defined as the rate at which the price of an asset rises, or falls, given a particular set of returns. It is often measured. Options volatility and trading capital · If volatility is 20%, that means theoretically the price of the stock is expected to be between +/– 20% from its current. Anyone who follows the stock market knows that some days market indexes and stock prices move up and other days they move down. This is called volatility. Higher volatility means an investment shows crazier price swings, while lower volatility means the investment tends to be smoother in price. The more volatile. As a result, volatile stocks have diverse meanings for different day traders. For some, it might signify equities with the greatest disparity between the day's. Investors and traders calculate the volatility of a security to assess past variations in the prices to predict their future movements. Volatility (Vol) stock. In finance, volatility (usually denoted by "σ") is the degree of variation of a trading price series over time, usually measured by the standard deviation. Volatility is how much an investment's price moves over time and how quickly those fluctuations occur. Volatility in the stock market as a whole can indicate. The speed or degree of change in prices is called volatility. The good news is that as volatility increases, the potential to make more money quickly also. Financial market volatility is defined as the rate at which the price of an asset rises, or falls, given a particular set of returns. It is often measured. Options volatility and trading capital · If volatility is 20%, that means theoretically the price of the stock is expected to be between +/– 20% from its current. Anyone who follows the stock market knows that some days market indexes and stock prices move up and other days they move down. This is called volatility. Higher volatility means an investment shows crazier price swings, while lower volatility means the investment tends to be smoother in price. The more volatile. As a result, volatile stocks have diverse meanings for different day traders. For some, it might signify equities with the greatest disparity between the day's. Investors and traders calculate the volatility of a security to assess past variations in the prices to predict their future movements. Volatility (Vol) stock. In finance, volatility (usually denoted by "σ") is the degree of variation of a trading price series over time, usually measured by the standard deviation. Volatility is how much an investment's price moves over time and how quickly those fluctuations occur. Volatility in the stock market as a whole can indicate. The speed or degree of change in prices is called volatility. The good news is that as volatility increases, the potential to make more money quickly also.

Volatile markets are characterised by extremely fast-paced price changes and high trading volume, which is seen as increasing the likelihood that the market. That's when uncertainty among investors can drive stock market volatility, when the prices of shares swing rapidly. What you need to know about volatility A. Unusually high spikes in volume of trading will usually correspond to volatility. Very low volume (as seen with so-called penny stocks that don't trade on major. Higher volatility means an investment shows crazier price swings, while lower volatility means the investment tends to be smoother in price. The more volatile. Stock market volatility is a measure of how much the stock market's overall value fluctuates up and down. For example, while the major stock indexes. The Daily Volatility of a security is the standard deviation of its daily return time series. It is commonly used as a measure of the risk of the security. How Does Stock Market Volatility Work? Volatility is the frequency and magnitude of the variance in the market pricing of an asset (or collection of assets). In other words, if the stock market is rising and falling significantly over time, it would be called a volatile market. The significance of low vs high. Volatility is the statistical tendency of a market to rise or fall sharply within a certain period of time. It is measured by standard deviations – meaning how. What does 'volatility' mean? Simply put, volatility is how much an asset or stock price changes over a specific period of time. It measures how much the price. What is volatility? Volatility is an investment term that describes when a market or security experiences periods of unpredictable, and sometimes sharp, price. It is a key metric because volatility creates profit potential. However, trading on volatility can also create losses, if traders do not learn the appropriate. What is Volatility Definition: It is a rate at which the price of a security increases or decreases for a given set of returns. Volatility is measured by. Did you know that there's a way to measure the expected volatility of the stock market? The VIX or Volatility Index allows you to do just that. It is one of. Market volatility is a normal and inevitable part of the stock market cycle and should be factored into your long- term investment strategy. It's like. In other words, if the stock market is rising and falling significantly over time, it would be called a volatile market. The significance of low vs high. Implied volatility is a measure of the expected volatility of a financial asset, such as a stock or option, that is derived from the current market price of the. If you talk about the volatility of the stock market, stock prices are most likely fluctuating wildly. Views expressed in the examples do not represent the. Stock volatility refers to the variation in a stock's price from its mean, and it can provide opportunities for investors. • Standard deviation, beta, VIX, and. This definition is a measure of the potential variation in price trend, not a measure of the actual price trend. For example, two stocks could have the same.

Dow Jones Stock Market Up Or Down

Jim Cramer's top 10 things to watch in the stock market Wednesday 29 Min Ago CNBC Daily Open: Stocks up ahead of Nvidia earnings 12 Hours Ago CNBC. stock market, and the most widely quoted indicator of U.S. stock market activity up or down in value with the value of the applicable index. Although ETF. Dow Jones Industrial Average ; Day Range40, - 41, ; 52 Wk Range32, - 41, ; Total Components30 ; Components Up28 ; Components Down2. Dow Jones Industrial Average News & Analysis · US stocks largely flat; Nvidia earnings loom large · 3 Blue-Chip Bargains Poised for Significant Upside as Dow. World markets ; Dow. United States. 40, ; S&P United States. 5, ; NASDAQ. United States. 17, ; VIX. United States. ; Russell Dow Jones Futures News & Analysis · Futures subdued as markets await Nvidia test · 3 Blue-Chip Bargains Poised for Significant Upside as Dow Keeps Making New. Historically, the United States Stock Market Index reached an all time high of in July of United States Stock Market Index - data, forecasts. Traders work on the floor of the New York Stock Exchange on June 14, Brendan Mcdermid | Reuters. The Dow Jones Industrial Average advanced to new. Today's market ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41,, (%) ; S&P INDEX, 5,, (%). Jim Cramer's top 10 things to watch in the stock market Wednesday 29 Min Ago CNBC Daily Open: Stocks up ahead of Nvidia earnings 12 Hours Ago CNBC. stock market, and the most widely quoted indicator of U.S. stock market activity up or down in value with the value of the applicable index. Although ETF. Dow Jones Industrial Average ; Day Range40, - 41, ; 52 Wk Range32, - 41, ; Total Components30 ; Components Up28 ; Components Down2. Dow Jones Industrial Average News & Analysis · US stocks largely flat; Nvidia earnings loom large · 3 Blue-Chip Bargains Poised for Significant Upside as Dow. World markets ; Dow. United States. 40, ; S&P United States. 5, ; NASDAQ. United States. 17, ; VIX. United States. ; Russell Dow Jones Futures News & Analysis · Futures subdued as markets await Nvidia test · 3 Blue-Chip Bargains Poised for Significant Upside as Dow Keeps Making New. Historically, the United States Stock Market Index reached an all time high of in July of United States Stock Market Index - data, forecasts. Traders work on the floor of the New York Stock Exchange on June 14, Brendan Mcdermid | Reuters. The Dow Jones Industrial Average advanced to new. Today's market ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41,, (%) ; S&P INDEX, 5,, (%).

Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more up and down. The stock market (^DJI, ^IXIC,^GSPC) has recovered from the growth concerns that emerged earlier in August. While many Wall Street analysts believe the sell-off. The stock market bounced back in when the Fed decided against hiking interest rates. The Dow was getting close to 30, by early ; on February Dow Jones Industrial Average ; Day Range 40, - 41, ; 52 Week Range 32, - 41, ; 5 Day. % ; 1 Month. % ; 3 Month. %. Dow Jones Industrial chemistry-oge-ege.ru 40,, , %Negative. trading lower. Nasdaq Composite chemistry-oge-ege.ru 17,, , %Negative. trading. Dow Jones Industrial Average ; 12 Month Change. % ; Day Range40, - 41, ; 52 Wk Range32, - 41, ; Total Components30 ; Components Up6. FTSE from 4 points and more hour markets than anywhere else. Find out more about why you should trade indices with IG. Discover why so many clients. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Audio Close Schwab Market Update · The S&P ® index (SPX) rose points (%) to 5,; the Dow Jones Industrial Average® ($DJI) rose (%) to. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. The Dow Jones Industrial Average increased % for the month and was up % YTD. The S&P MidCap gained % for the month, bringing its YTD return to. The Dow Jones Industrial Average increased % for the month and was up % YTD. The S&P MidCap gained % for the month, bringing its YTD return to. Dow Jones - Top Gainers ; McDonald's, , , %, AM08/28/ AM UTC ; Walmart, , After nearly years as a marker of major market developments, the DJIA is still one of the most recognized and cited of all market indexes. The index may not. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. Dow Jones publishes the world's most trusted business news and financial information in a variety of media. It delivers breaking news, exclusive insights. What's new, hot and trading on the TSX today? Start your Canadian stock market research with a daily market activity summary, including today's stock market. 3 Blue-Chip Bargains Poised for Significant Upside as Dow Keeps Making New Highs · US futures little changed as Nvidia earnings eyed · U.S. stocks higher at close. The Dow Jones U.S. Total Stock Market Index, a member of the Dow Jones Total Stock Market Indices family, is designed to measure all U.S. equity issues with.

Whats Better Doordash Or Grubhub

Uber you can count on anywhere from 15 minutes to never showing late. What I absolutely hate about Doordash is their habit of doubling up orders on delivery. What is DoorDash? You've likely heard of DoorDash, but what exactly is One option is to sign up for a food delivery service like DoorDash or Grubhub. Both GrubHub and DoorDash offer pros and cons as far as deliveries go; typically, GrubHub offers lower payments but greater stability in hourly rates, while. GrubHub also lately When it's slow is it better to get paid by the hour or by order? DoorDash and UberEats win for simplicity of being able to drop an order. Grubhub again lags behind in terms of ease of use within the app. However, Grubhub does. GrubHub is better than DoorDash. Several GrubHub restaurants use their own delivery drivers for more efficient delivery speeds, and service fees tend to be. Compare company reviews, salaries and ratings to find out if DoorDash or Grubhub is right for you. DoorDash is most highly rated for Work/life balance and. By differentiating themselves from the likes of Uber Eats and GrubHub and claiming their own space in the food delivery market, DoorDash was able to find a gap. DoorDash vs Grubhub: Self-Scheduling. Winner: DoorDash because they are more transparent about who can schedule shifts at what time. The gig economy is great. Uber you can count on anywhere from 15 minutes to never showing late. What I absolutely hate about Doordash is their habit of doubling up orders on delivery. What is DoorDash? You've likely heard of DoorDash, but what exactly is One option is to sign up for a food delivery service like DoorDash or Grubhub. Both GrubHub and DoorDash offer pros and cons as far as deliveries go; typically, GrubHub offers lower payments but greater stability in hourly rates, while. GrubHub also lately When it's slow is it better to get paid by the hour or by order? DoorDash and UberEats win for simplicity of being able to drop an order. Grubhub again lags behind in terms of ease of use within the app. However, Grubhub does. GrubHub is better than DoorDash. Several GrubHub restaurants use their own delivery drivers for more efficient delivery speeds, and service fees tend to be. Compare company reviews, salaries and ratings to find out if DoorDash or Grubhub is right for you. DoorDash is most highly rated for Work/life balance and. By differentiating themselves from the likes of Uber Eats and GrubHub and claiming their own space in the food delivery market, DoorDash was able to find a gap. DoorDash vs Grubhub: Self-Scheduling. Winner: DoorDash because they are more transparent about who can schedule shifts at what time. The gig economy is great.

What's New. Version History. Aug 26, Version We've cooked up some grub hub don't make it any better. Thanks for nothing. more. Developer. Doordash is better here but Uber does hit you with nice delivery orders, every so often. Other posts. Here are five key tricks to get more orders and make more money on UberEats, Grubhub, DoorDash, and Postmates After all, if we assume a higher DoorDash. Browse faster in the app$0 delivery fee on first order. M ratings. Open. 0 items in cart. doordash has more drivers, so most likely faster service. Grubhub charges less fees though. also if you tip more, you'll get your food quicker. Also for grubhub drivers no matter what they don't get paid less than 7 dollars an order where with doordash if you don't tip or only tip a. Browse faster in the app$0 delivery fee on first order. M ratings. Open · DoorDash · Login. As with DoorDash, GrubHub's delivery drivers make % of any top income and don't charge withdrawal fees on earnings. As such, it's rapidly becoming a more. eligible to become part of. Which Is Better Doordash Or Grubhub For Drivers Cash Out option, which costs $0. Included in this guide. So since I started dashing I have only used dasher direct, Never used direct deposit. Thought about switching but how accurate is pay day? Is it. Postmates pays better than DoorDash and UberEats, now that's out of the way, let's check out why. Tips are the main reason, and they are based on the size of. Grubhub is a takeout and delivery software for corporates and restaurants to build food orders, manage payments, and track. Sign up to deliver with Grubhub! It's flexible & easy to earn cash on your schedule and keep % of your tips. No resume, interview, or experience. When in doubt, go for takeout—Grubhub has it all! Order food delivery from thousands of restaurants, including local spots and national chains. The best DoorDash for Merchants alternatives are Uber Eats for Merchants, ChowNow for Restaurants, and GrubHub A Faster Better Direct Delivery Solution. It's hard to believe that the three biggest restaurant delivery companies have been around for less than fifteen years. DoorDash, GrubHub, and UberEATS have. Reviewers felt that GrubHub for Restaurants meets the needs of their business better than DoorDash for Merchants. · When comparing quality of ongoing product. When it comes to gift cards, how do you pick between DoorDash, Uber Eats, Grubhub and Postmates higher. Be aware that many restaurants require a. Sign up to deliver with Grubhub! It's flexible & easy to earn cash on your schedule and keep % of your tips. No resume, interview, or experience. The best restaurants near you deliver with Grubhub! Order delivery or takeout from national chains and local favorites! Help support your neighborhood.

Do I Need Rental Car Insurance

Your auto policy should be sufficient as long as you have confirmed the coverage carries over while renting. Be certain to do a full walk. If you have insurance for your own cars, including collision and comprehensive coverages, you don't need the rental car insurance. Rental car insurance is not required by law and may already be covered by your personal car insurance. Rental car insurance, sometimes called rental car coverage, is a type of protection that is offered at the time of rental to cover you when you rent a vehicle. The coverage and deductibles you have on your auto insurance policy apply in most cases when you rent a car, as long as it's for personal use and you are. You need to have full coverage on your personal vehicles in order to have the full coverage extend to a rental car. Rental car insurance can help protect you from out-of-pocket expenses in case of an accident, theft, or damage to the rental vehicle, but the daily fee will. In most cases, whatever auto insurance and deductibles you have on your own car would apply when you rent a car. No, you do not need your own personal car insurance in order to rent a car from Enterprise. We offer several different types of car rental insurance plans and. Your auto policy should be sufficient as long as you have confirmed the coverage carries over while renting. Be certain to do a full walk. If you have insurance for your own cars, including collision and comprehensive coverages, you don't need the rental car insurance. Rental car insurance is not required by law and may already be covered by your personal car insurance. Rental car insurance, sometimes called rental car coverage, is a type of protection that is offered at the time of rental to cover you when you rent a vehicle. The coverage and deductibles you have on your auto insurance policy apply in most cases when you rent a car, as long as it's for personal use and you are. You need to have full coverage on your personal vehicles in order to have the full coverage extend to a rental car. Rental car insurance can help protect you from out-of-pocket expenses in case of an accident, theft, or damage to the rental vehicle, but the daily fee will. In most cases, whatever auto insurance and deductibles you have on your own car would apply when you rent a car. No, you do not need your own personal car insurance in order to rent a car from Enterprise. We offer several different types of car rental insurance plans and.

Do you need rental car insurance coverage? Your auto insurance may cover rental cars or your credit card may offer some rental coverage. In order for your primary insurance to cover your rental car you need three types of coverage: liability, collision, and comprehensive. Another important thing to keep in mind when figuring out whether or not your auto insurance covers your car rental is the purpose of the trip. If your personal. Liability Insurance – By law, rental companies must provide the state required minimum amount of liability insurance coverage—often this does not provide enough. As long as you have Personal Injury Protection or medical payments coverage on your auto policy and reliable health insurance, you may not need this coverage. Not necessarily. In Massachusetts, your auto insurance policy follows you in the US, Canada and US territories when you rent a car, so the extra rental. One of the big questions when renting a car, truck, or trailer usually is “Do I need the insurance the rental car company is offering?” The following tips. Just note that comprehensive and collision insurance are optional in a personal auto policy. If you don't have them, you may want to consider purchasing the. Do I need a rental car insurance plan? For any vacation it's smart to cover your travel investment, but when you're driving it can be even more beneficial. Basic liability – This protection does not offer any coverage to your vehicle in the event of a crash. Remember that the rental is considered “your” car for. Primary coverage covers the full loss of the rental vehicle through damage or theft and can help you keep your auto insurance premiums down if you do get into. Do I need rental car insurance? No. Rental car insurance isn't required to rent a car. However, Costco Travel highly recommends it for your protection. If your car is totaled, many companies will pay for your rental as a courtesy, but they are not required to do so. If you are filing a claim with your own. If your car is totaled, many companies will pay for your rental as a courtesy, but they are not required to do so. If you are filing a claim with your own. You will have collision coverage on the rented auto as long as you have it on at least one vehicle on your policy. If you are renting something bigger than a. Renting without auto insurance. While you don't need to have your own insurance policy to rent a car, it's a smart idea to purchase rental car insurance when. With most personal auto policies, your coverage extends to vehicles that you rent on a temporary basis and drive yourself. You're covered as if you're driving. You will need to meet minimum standards for liability, and you can rest assured that the rental insurance will cover you in the event of an accident. You can. In order for your primary insurance to cover your rental car you need three types of coverage: liability, collision, and comprehensive.

Renters Insurance Cost In California

Ask an agent · Get a quote · Or, call If your tenant wishes to receive a free quote for Renters Insurance, they can start the quote process below: Renters Insurance Quote. Popular Topics. Rent. The average premium for a renters policy is $16¹ per month, and as low as $4² per month when you bundle with an auto policy. Take a look at the coverage options. According to the Insurance Information Institute, the average renters insurance premium in was $ Remember, your renters insurance cost is unique to. If your tenant wishes to receive a free quote for Renters Insurance, they can start the quote process below: Renters Insurance Quote. Popular Topics. Rent. The average renters insurance premium in California is $, which is close to the national average. The costs varies a lot from the cost of your personal. An Allstate renters policy has an average monthly premium of about $16¹. If you also insure your car with Allstate, you may be able to pay around $4* a month. Mercury Insurance has you covered with renters insurance in California. Get a renters insurance quote in just minutes for great coverage at a low price! The average monthly cost of renters insurance in California tends to be between $14 and $22 in major cities. But how much you pay on renters insurance will. Ask an agent · Get a quote · Or, call If your tenant wishes to receive a free quote for Renters Insurance, they can start the quote process below: Renters Insurance Quote. Popular Topics. Rent. The average premium for a renters policy is $16¹ per month, and as low as $4² per month when you bundle with an auto policy. Take a look at the coverage options. According to the Insurance Information Institute, the average renters insurance premium in was $ Remember, your renters insurance cost is unique to. If your tenant wishes to receive a free quote for Renters Insurance, they can start the quote process below: Renters Insurance Quote. Popular Topics. Rent. The average renters insurance premium in California is $, which is close to the national average. The costs varies a lot from the cost of your personal. An Allstate renters policy has an average monthly premium of about $16¹. If you also insure your car with Allstate, you may be able to pay around $4* a month. Mercury Insurance has you covered with renters insurance in California. Get a renters insurance quote in just minutes for great coverage at a low price! The average monthly cost of renters insurance in California tends to be between $14 and $22 in major cities. But how much you pay on renters insurance will.

The average cost of renters insurance is about $15 to $20 per month 1. However, what you end up paying depends on a number of factors. Across the U.S., the average cost of renters insurance is around $18/month, as of The average cost of Lemonade renters insurance is around $14 a month but. Renters insurance covers you and your stuff. Enjoy more peace of mind for as little as 33 cents a chemistry-oge-ege.ru note1. Get a quote. The University of California recommends that students consider purchasing Renters Insurance if living away from home. Renters Insurance is not mandatory. The average cost of renters insurance through Progressive ranges from $14 to $30 per month, depending on your state, according to data from Progressive. Home & Renters Insurance | Mobile and Condo | California Casualty. Home and Renters Insurance. Get a Quote Today. It's about service for you. Home Insurance. To help find competitive rates the CDI is pleased to offer online premium comparisons that cover over 90% of California's homeowners and renters insurance. Looking for renters insurance in California? We've got you covered! Find out how much it will cost to insure your belongings. Get a quote today! On average, AmFam's insurance coverage costs $20 per month in California. This price is mainly based on your zip code and the property's location. Claims. To. California Casualty offers competitive rates and excellent service to education and public safety association members, credit unions, and select employer. The average cost of renters insurance in California is $ per year or around $20 a month. This is 49% higher than the national average. Is renters insurance. Renters insurance runs about $15 a month for approximately $35, in coverage limits, based on the National Association of Insurance Commissioners (NAIC). We also offer optional coverages that can customize your renters insurance policy such as limited earthquake coverage, increased limits on items of higher value. We compare renters insurance quotes to find you the best coverage at the lowest price—and it takes less than three minutes to get a quote. Get a free renters insurance quote from State Farm with our simple online tool. How much does renters insurance cost? Find out now and apply for coverage. For as little as $5 a month, renters insurance is a surprisingly cheap way to keep the things you love safe and protected. Get a free online quote. CEA earthquake insurance for renters could cost as little as $35 per year. The cost of your policy depends on factors like where you live, and the coverages. The University of California recommends that students consider purchasing Renters Insurance if living away from home. Renters Insurance is not mandatory. The average cost of renters insurance is about $15 to $20 per month 1. However, what you end up paying depends on a number of factors. According to PropertyNest research, the average basic renters insurance policy in California is $ per month or $ a year. PropertyNest researched and.

Investors That Buy Houses

Nationwide Investors Group provides homeowners with a fast, fair cash offer for their home, land, and multi-family properties all over US. Besides using a fast buyer like LDN Properties, there are other ways to find an investor who wants to buy your home – you could try selling it through an. SLG Home Buyer is one of the leading House Buying Companies in Ontario. We are the local investors who help house owners like you to sell their property fast. As direct cash investors, we won't apply for a mortgage or order unnecessary reports when we buy your house. You won't have to deal with real estate agents or. First, it's important that you research different companies and find one that you trust. There are many “we buy houses” companies out there, but not all of them. We are local Home Investors to serve all of your needs – Never any fees. Multiple selling and moving options to make things easy. We are Ranked Among the Top. A Private Home Buyer buys a house to resell it to individuals, retaining the house as their investment. Kendall Partners provides real solutions for property owners all over Chicago who wish to sell their houses. If you are facing a divorce and need to sort out. Locate and buy investment properties through We Buy Houses. Leads, wholesales, flips and rehabs. Nationwide Investors Group provides homeowners with a fast, fair cash offer for their home, land, and multi-family properties all over US. Besides using a fast buyer like LDN Properties, there are other ways to find an investor who wants to buy your home – you could try selling it through an. SLG Home Buyer is one of the leading House Buying Companies in Ontario. We are the local investors who help house owners like you to sell their property fast. As direct cash investors, we won't apply for a mortgage or order unnecessary reports when we buy your house. You won't have to deal with real estate agents or. First, it's important that you research different companies and find one that you trust. There are many “we buy houses” companies out there, but not all of them. We are local Home Investors to serve all of your needs – Never any fees. Multiple selling and moving options to make things easy. We are Ranked Among the Top. A Private Home Buyer buys a house to resell it to individuals, retaining the house as their investment. Kendall Partners provides real solutions for property owners all over Chicago who wish to sell their houses. If you are facing a divorce and need to sort out. Locate and buy investment properties through We Buy Houses. Leads, wholesales, flips and rehabs.

Buy-and-hold investors seek to hold onto the house as it and the neighborhood increase in value, and often rent the homes out to tenants. · iBuyers, also called. REIGs are an option for passive investing in real estate. REITs pay dividends and can be bought and sold on exchanges, like stocks. Online real estate investing. I am a real estate investor that buys houses for flipping and rental purposes. I am not a Real Estate Agent, so I do not charge any commission or fees. A “We Buy Houses” cash investor in the Seattle area can help you sell your home quickly and get cash for your equity right away. Real Estate Companies That Buy Homes are Professional Real Estate Investors who buy houses from Sellers every day regardless of the Seller's situation and. Here's the truth. (And I've done both—operated as a Realtor and as a cash buyer.) The companies that buy houses for cash will either. Locate and buy investment properties through We Buy Houses. Leads, wholesales, flips and rehabs. Cash out your home equity without moving out or taking on debt. Get a no-obligation offer on your home in 48 hours, and find out if Truehold is right for. We are local Home Investors to serve all of your needs – Never any fees. Multiple selling and moving options to make things easy. We are Ranked Among the Top. Money/cash disclaimer We not buy houses by counterfeit or fake money banknotes even from chemistry-oge-ege.ru Your Name Your Email Your Phone Number Best time. Want to sell your house to investor in Illinois? At chemistry-oge-ege.ru we reviewed + Illinois cash home buyers and vetted 25 best companies that buy. We Buy Ugly Houses is the most trusted name in the business, operating by the highest systems and standards in the industry. We're proud to be America's #1 Home. Who You'll Be Dealing With On The Sale: If I were trying to find a real estate investor in San Antonio, TX to buy my house, one of my first questions would. We are professional cash home buyers that buy houses fast in Ontario. We buy houses as-is without real estate agent fees, commissions, or closing costs. About Us. WE BUY HOUSES – ANY CONDITION IN ONTARIO. Home Buyer is a Canadian. At Home Investors, we are a dedicated team of investors who buy houses for cash offers. We help homeowners sell fast in every market and are ready to pay a. Interested in connecting with a local California investor who offers cash for houses? Simply submit our form, and you'll receive an offer from a cash buyer. Cash out your home equity without moving out or taking on debt. Get a no-obligation offer on your home in 48 hours, and find out if Truehold is right for. Want to sell your house to investor in Alaska? At chemistry-oge-ege.ru we reviewed + Alaska cash home buyers and vetted 25 best companies that buy houses. First, whether your house is “ugly”, “Trashed” or “will be foreclosure soon”, we buy it from you, hassle free and no hidden fees. In addition, we buy houses for.

How Is Heloc Interest Rate Calculated

When you have a variable interest rate on your home equity line of credit, the rate can change from month to month. The variable rate is calculated from both an. Maximum interest rate is 17%. 2 Rate and payments are based on Prime plus a margin. Changes to Prime will result in changes to the rate and payment. After your. Use our home equity line of credit (HELOC) payoff calculator to figure out your monthly payments on your home equity line based on different variables. Yes, BECU's HELOC interest rates are based on the prime rate plus a margin. The exact margin can vary throughout the life of the loan based on factors like your. Home equity loans may offer lower interest rates and access to larger funds. A home equity loan often comes with a lower interest rate than other loans since. For some home equity lines of credit, the monthly payment during the draw period may include only the needed amount to pay the monthly interest on the. The minimum monthly payment for the balance on your equity line. The minimum monthly payment is calculated as % of the interest owed for the period. A HELOC payment calculator makes estimating your monthly payments and interest rate easy. Check out Flagstar to plan your mortgage payments. The monthly required payment is based on your outstanding loan balance and current interest rate (interest rates can increase or decrease), and may vary each. When you have a variable interest rate on your home equity line of credit, the rate can change from month to month. The variable rate is calculated from both an. Maximum interest rate is 17%. 2 Rate and payments are based on Prime plus a margin. Changes to Prime will result in changes to the rate and payment. After your. Use our home equity line of credit (HELOC) payoff calculator to figure out your monthly payments on your home equity line based on different variables. Yes, BECU's HELOC interest rates are based on the prime rate plus a margin. The exact margin can vary throughout the life of the loan based on factors like your. Home equity loans may offer lower interest rates and access to larger funds. A home equity loan often comes with a lower interest rate than other loans since. For some home equity lines of credit, the monthly payment during the draw period may include only the needed amount to pay the monthly interest on the. The minimum monthly payment for the balance on your equity line. The minimum monthly payment is calculated as % of the interest owed for the period. A HELOC payment calculator makes estimating your monthly payments and interest rate easy. Check out Flagstar to plan your mortgage payments. The monthly required payment is based on your outstanding loan balance and current interest rate (interest rates can increase or decrease), and may vary each.

Interest-only payments are based on the outstanding loan balance and interest rate. During the repayment period, the payment includes both repayment of the. HELOC typically come with a variable interest rate, which means the interest charged on the loan is based on a financial index that varies. As the financial. Use our debt consolidation calculator to get an idea of a rate and monthly payment. Your interest rate and monthly payment may vary over the life of your loan. For home equity mortgage loans, excluding home equity lines of credit, it is a fixed rate, and it includes the interest rate plus any other charges or fees. For. To calculate the daily interest rate, you divide the annual percentage rate (APR) by the number of days in the year. For instance, if your APR on a HELOC is. *APR=Annual Percentage Rate. The initial interest rate is fixed for the first five years of the loan and then adjusts to the fully indexed variable rate at the. HELOCs have a similar payment structure as credit cards, and they have variable rates. HELOCs typically have lower interest rates than credit cards and other. How is the HELOC interest rate determined? The Annual Percentage Rate (APR) for a HELOC is calculated based on a variety of factors, including credit score. A loan-to-value ratio is calculated by taking total mortgage debt (including any second mortgages or existing home equity loans) and dividing it by the current. Things to consider when calculating line of credit payments. Interest rate. A conventional mortgage calculates interest using a method known as compound interest. When you first take out the loan, the entire amount owed is calculated in. Interest isn't calculated once. It's calculated repeatedly - at least once a year, but usually daily and often continuously. That means that at. The minimum monthly payment is calculated as % of the interest owed for the period. mortgage, while only paying a higher interest rate on the second. Home Equity Line of Credit (HELOC) payments are calculated based on the loan's outstanding balance, interest rate and the repayment period. During the draw. How to calculate your potential home equity loan or HELOC amount yourself · Multiply your home's value by 85% () · Subtract the amount you have left to pay on. Calculate home equity by using your home's current market value and subtracting what you owe. The loan-to-value (LTV) ratio is a lending risk assessment ratio. The lenders who offer HELOCs will extend a percentage of your home's value as your credit limit. They determine this amount by dividing the appraised value of. Move forward with flexibility · Traditional HELOC: payments are 1% of the outstanding loan balance, plus interest · Interest-only HELOC: payments are the interest. How Home Equity Loans Work Lenders may also require you to pay points—that is, prepaid interest—at closing time. Each point is equal to 1% of the loan value Monthly Payment Calculator for Home Equity Loan · Loan Amount: $ · Interest rate: % · Term (months): · * indicates required field.

How To Finance A Boat Purchase

When you're ready to buy, your US Bank boat financing pre-approval is good at any of our participating dealerships. Keep in mind certain banks offer special rates, and if you would like to get an exact payment for your boat purchase, you can fill out a secure online. Use the BoatUS boat loan calculator to calculate your boat loan by monthly boat loan payments or total boat loan. Fill out a Free Online Application today. Finance your new boat purchase at the best rates through Iron Wind's in house financing specialists. Iron Wind has extensive experience in the marine. Another alternative is a credible lender specializing in boat loans. Benefits include purchasing factory-backed extended service plans and other loan protection. We do not require any additional collateral other than the boat you are purchasing (OAC). Additionally, we offer the option for extended amortization, allowing. Another alternative is a credible lender specializing in boat loans. Benefits include purchasing factory-backed extended service plans and other loan protection. The amount of the down payment on a boat loan varies. It's usually anywhere from 10 percent to more than 30 percent. It depends on the borrower's credit score. If I were you I'd just call a loan broker and talk it through with them. I got my boat loan through Trident Funding and had a good experience. When you're ready to buy, your US Bank boat financing pre-approval is good at any of our participating dealerships. Keep in mind certain banks offer special rates, and if you would like to get an exact payment for your boat purchase, you can fill out a secure online. Use the BoatUS boat loan calculator to calculate your boat loan by monthly boat loan payments or total boat loan. Fill out a Free Online Application today. Finance your new boat purchase at the best rates through Iron Wind's in house financing specialists. Iron Wind has extensive experience in the marine. Another alternative is a credible lender specializing in boat loans. Benefits include purchasing factory-backed extended service plans and other loan protection. We do not require any additional collateral other than the boat you are purchasing (OAC). Additionally, we offer the option for extended amortization, allowing. Another alternative is a credible lender specializing in boat loans. Benefits include purchasing factory-backed extended service plans and other loan protection. The amount of the down payment on a boat loan varies. It's usually anywhere from 10 percent to more than 30 percent. It depends on the borrower's credit score. If I were you I'd just call a loan broker and talk it through with them. I got my boat loan through Trident Funding and had a good experience.

Financing a boat is one of the most common ways to purchase a new vessel. However, figuring out the ins and outs of applying for a boat loan isn't always. Banks will typically lend up to 80% of your purchase price, meaning you will need at least 20% cash down. With a thorough review of your financing package, we. Colorful, interactive, simply The Best Financial Calculators! Use this calculator to help you determine your monthly boat loan payment or your boat purchase. Less cash required upfront · No need to spend your savings or liquidate your stocks · Invest the money you would have used to purchase the boat outright · Have. Loan terms are typically between 10 and 20 years. As of September , interest rates for yacht loans start around % for well qualified borrowers. Short-. Keep in mind, most banks will require you to fork out between 10 and 15 percent as a down payment on a boat purchase. If you're set on going to the bank for. Like auto loans and mortgages, boat loans are typically secured loans, meaning your lender will likely require that you pledge an asset of value as collateral. Another alternative is a credible lender specializing in boat loans. Benefits include purchasing factory-backed extended service plans and other loan protection. Our team of financing experts can arrange the best boat loans in no time. With our financing, you can either see what boats we have in our inventory. Financing your boat · Step 1: Initial Inquiry. You can complete an online application or call us at any stage. · Step 2: Soft Credit Check · Step 3. Originally was planning to buy outright, but surprised to see the long loan terms for boat loans and reasonable rates. Curious how many of you. When buying a used boat from a private seller that has an outstanding loan balance, your lender will need an up to date payoff prior to giving final approval to. Interest rates range from % to 18% depending on credit, age of vessel and down payment and change based on market conditions. The process of getting a boat. For boat loans, you'll typically need to make a down payment between 10% and 20% of the purchase price, though some may offer no down payment as an incentive. Typically, you'll need to make a down payment — perhaps 10% or 20%— although that isn't universally true. You'll also need to meet the financial institution's. The term of a loan has a huge impact on the amount of the monthly payments, and we have great news: these days, it's quite common to finance a boat for up to financing easy and simple with the purchase of a new boat or used boat. Atlantis Marine financing. We are more than happy to help you finance any inventory. Our new and used boat loans come with flexible terms and some of the lowest interest rates around. That means you can get a lower boat loan rate or monthly. Select the options that apply to you and enter how much money you're looking to borrow for financing your boat. purchase a sailboat, power boat or.

Royal Caribbean Pay

As of Sep 3, , the average hourly pay for a Royal Caribbean Cruise in Florida is $ an hour. While ZipRecruiter is seeing salaries as high as $ You can make a payment online by accessing your reservation if you have booked directly with Royal Caribbean following the steps below. The average Royal Caribbean group monthly salary ranges from approximately $1, per month for Photographer to $11, per month for Physician. Royal Caribbean Cruises · FIND A CRUISE · DEALS · SHIPS Select fare programs require the payment at the time of booking of a nonrefundable deposit. Final payment of the balance must be received at Royal Caribbean's offices at least 75 days prior to the sailing date for 1 to 4 night cruise vacations. Uniforms will be provided onboard and there are some uniform items that are considered personal items crew are required to pay for. Royal Caribbean Group. Salaries by job title at Royal Caribbean Group ; Manager. 60 Salaries submitted. $77K-$K · $91K | $12K ; Analyst. 49 Salaries submitted. $66K-$K · $76K | $6K. Average Royal Caribbean group Crew Member hourly pay in the United States is approximately $, which is 33% above the national average. Explore vacation financing options for your dream cruise with payment plans, credit cards, and more. Start budgeting now for your next relaxing getaway. As of Sep 3, , the average hourly pay for a Royal Caribbean Cruise in Florida is $ an hour. While ZipRecruiter is seeing salaries as high as $ You can make a payment online by accessing your reservation if you have booked directly with Royal Caribbean following the steps below. The average Royal Caribbean group monthly salary ranges from approximately $1, per month for Photographer to $11, per month for Physician. Royal Caribbean Cruises · FIND A CRUISE · DEALS · SHIPS Select fare programs require the payment at the time of booking of a nonrefundable deposit. Final payment of the balance must be received at Royal Caribbean's offices at least 75 days prior to the sailing date for 1 to 4 night cruise vacations. Uniforms will be provided onboard and there are some uniform items that are considered personal items crew are required to pay for. Royal Caribbean Group. Salaries by job title at Royal Caribbean Group ; Manager. 60 Salaries submitted. $77K-$K · $91K | $12K ; Analyst. 49 Salaries submitted. $66K-$K · $76K | $6K. Average Royal Caribbean group Crew Member hourly pay in the United States is approximately $, which is 33% above the national average. Explore vacation financing options for your dream cruise with payment plans, credit cards, and more. Start budgeting now for your next relaxing getaway.

The estimate average salary for Royal Caribbean International Cruises employees is around $99, per year, or the hourly rate of Royal Caribbean International. The average RCL salary in the United States is $47, per year. RCL salaries range between $24, a year in the bottom 10th percentile to $90, in the top. Pay your balance online. It is easy and secure. Visit our Make A Payment page to complete the process. The average Royal Caribbean group monthly salary ranges from approximately $1, per month for Photographer to $11, per month for Physician. Pay your balance online. It is easy and secure. Visit our Make A Payment page to complete the process. Explore vacation financing options for your dream cruise with payment plans, credit cards, and more. Start budgeting now for your next relaxing getaway. Royal Caribbean Cruising | In September I paid, in full, the balance If we did pre pay who would that have went to? Rebecca. To pay, call or click here to pay online. In order to avoid cancellation, make your payment by phone before the due date listed. Access to our award-winning Online and Mobile Banking. Bank on the go from almost anywhere quickly and securely. Pay your credit card bill online, transfer. Once there, select “Pay the total balance" and “Use this payment method” box in the Affirm section under “How would you like to pay”. You will make payments. Final payment of the balance must be received at Royal Caribbean's offices at least 75 days prior to the sailing date for 1 - 4 night cruise. How much do Royal Caribbean Cruise jobs pay per hour? Average hourly pay for a Royal Caribbean Cruise job in the US is $ Salary range is $ to. FlexPay – Our new Scheduled Payment program lets you and your clients customize how and when they pay their reservation balance. • Schedule Payments - With. Buy now, pay later at Royal Caribbean with Sezzle to get interest-free financing and pay in 4 easy, budget friendly installments - no hard credit check. Sign in to make a payment, add guests info, and more. Sign in. Or look up your reservation using your cruise information. Reservation number. Last name. Ship. Final payment of the balance must be received at Royal Caribbean's offices at least 75 days prior to the sailing date for 1 to 4 night cruise vacations. Salaries by job title at Royal Caribbean Group ; Financial Analyst. 25 Salaries submitted. $66K-$98K · $74K | $6K ; Revenue Management Analyst. 18 Salaries. © Royal Caribbean Cruises Ltd. Ships' registry: The Bahamas. FlexPay. Schedule Payments. Individual Reservation. FlexPay – Our new Scheduled Payment program. Royal Caribbean accepts Visa, MasterCard, American Express, Optima, Diner's Club International and Discover cards. The average salary for Royal Caribbean International is $k per year, which includes an average base salary of $k and an average bonus of $17k.

Find Best Car Loan Rates

Rates as of Aug 31, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Luckily, Birchwood Credit Solutions has a nifty online tool to help you determine your budget. We'll show you how our Car Loan Calculator works and explain why. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. The interest rate on a car loan can vary depending on a number of different factors. These can include the type of vehicle you are purchasing, your credit score. When you're shopping for a car, who has the best car loan rates? Let Elgin Chrysler Dodge Jeep RAM help you find an auto loan rate that fits your budget. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. The three main factors in getting the best rate for an auto loan are your credit score, finances and the lender. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts Find the car and financing. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. Rates as of Aug 31, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Luckily, Birchwood Credit Solutions has a nifty online tool to help you determine your budget. We'll show you how our Car Loan Calculator works and explain why. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. The interest rate on a car loan can vary depending on a number of different factors. These can include the type of vehicle you are purchasing, your credit score. When you're shopping for a car, who has the best car loan rates? Let Elgin Chrysler Dodge Jeep RAM help you find an auto loan rate that fits your budget. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. The three main factors in getting the best rate for an auto loan are your credit score, finances and the lender. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts Find the car and financing. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America.

You'll be in a better position to get a low interest rate on a used car loan when you understand why used car loans cost more than new car financing, know how. Let us do the shopping for you. Get discounted pricing and our best rates on your next vehicle purchase in partnership with TrueCar. Rates starting at % APR. To get the very best car interest rate in Canada, Hamilton drivers should check their credit score in advance, then look at the chart above to determine what. You'll find Valley Strong Auto Finder provides a great auto buying experience thanks to built-in benefits like: DealerRater reviews and ratings from car buyers. Compare car loans from multiple lenders to find your best rate and learn what you need to know about financing before you apply. The current interest rate for car loans can vary depending on several factors, including your credit score, the loan term, and the lender you choose. However. Shopping for a car? If you need a auto loan, find out how much you can borrow, and compare financing options. Calculating your payments is easy! TLDR - Check out local credit unions and banks for best interest rates. Apply for the loan at the place with the best rates to find out how much. Vehicle Loan Calculator We offer financing options for new or used cars, SUVs, trucks, vans and recreational vehicles that are sold privately or through. There's more to an auto loan than that 0% interest enticement. 1. Credit history. Congratulations to those of you with a great credit score, but your credit. Shop, finance and drive. Find the car and financing that's right for you. Get a fast credit decision, competitive rates with a 30 day rate lock. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. Best Auto Loan Rates: Best for Fast Funding. CNN Underscored.. Best Our online car loan calculator will help you estimate your payments so you can find. Car Loan Rates · First National Bank • Used Car Loan • 72 Months · LightStream • Used Car Loan • 72 Months · Popular Bank • Used Car Loan • 72 Months · WSFS Bank •. rates people have been getting lately and with who? Seems like the best rates I'm finding are with credit unions what about you guys? Upvote. Free auto loan calculator to determine the monthly payment and total cost of an auto find the best deals to suit your individual needs. Once a particular make. Car Loan Calculator · Find out what loan rates you qualify for! · Current Lowest Rates · % · We find the best deal, at the best bank so you don't have to. 2- What is a good new or used car interest rate for a car loan? The car finance rates for a new cars and trucks such as the new Dodge Ram can be as low. To calculate the estimated interest rate on a car loan, you'll need to evaluate the total loan amount, the length of the loan (loan term), and the annual. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %.

1 2 3 4 5 6